No Record Found

Latest News

Indian shares set to open higher after US Supreme Co...

Gold rises as dollar falls on US Supreme Court tarif...

India`s capex contracts 23.4 pc in Q3 due to some ad...

PM Narendra Modi hails rice revolution & Kerala Kumb...

India committed to making global clean energy transi...

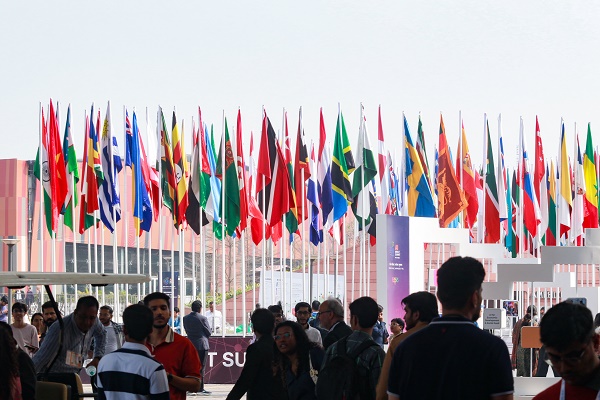

India Impact Summit shows how AI will be governed, d...

Foreign investors offload $6.2 billion on main Seoul...

DIIs continue to provide strong support to markets d...

US tariff refund could be a `mess` but a psychologic...

IT Sector Update : Palantir, Anthropic, and its impa...

Top News

News Not Found

Tag News

News Not Found

More News

News Not Found