Weekly Commodity Insights 6th October 2025 by Axis Securities

The Week That Was

• Gold prices surged to fresh record highs this week as political turmoil in Washington spurred safe-haven demand. The rally followed the U.S. government shutdown after a Republican-backed spending bill failed to pass the Senate. The shutdown has delayed key labour market and inflation data, complicating the Federal Reserve’s policy outlook. Even so, markets continue to price in two more rate cuts this year, further enhancing gold’s appeal as a non-yielding asset. The heightened uncertainty has kept investors tilted towards safe havens, lifting other precious metals as well.

• Silver prices advanced on Friday, hovering near record highs and marking a seventh consecutive weekly gain. The metal was supported by mounting concerns over the economic fallout from a prolonged U.S. government shutdown and by expectations of rate cuts. The non-farm payrolls report, originally scheduled for Friday, was postponed, leaving investors reliant on alternative indicators that suggest a cooling labour market. Markets are currently pricing in a 97% chance of a 25 bps rate cut in October and an 85% probability of another in December.

• Oil prices closed higher but posted sharp weekly losses, with Brent down 8.1%—its steepest weekly decline in over three months—and WTI tumbling 7.4%. The sell-off was driven by expectations of increased OPEC+ output and the restart of Iraq’s Kurdish pipeline after a two-year halt. Saudi Arabia has pushed for a large output hike to regain market share, while Russia has proposed a more modest rise. Additional supply concerns, combined with seasonal refinery maintenance and slowing demand, are likely to weigh on crude sentiment in the weeks ahead.

• Copper futures climbed above $4.9 per pound in the last session, reaching two-month highs as supply disruptions tightened the outlook. Operations at Indonesia’s Grasberg mine remain suspended following a mud-flow accident, with full capacity unlikely to return before 2027. Operator Freeport-McMoRan has already cut its 2026 sales guidance by 35%. Meanwhile, Chile’s output fell nearly 10% YoY in August, the steepest drop since 2023, after an earthquake forced Codelco to halt operations at its El Teniente mine and smelter. On the demand side, stronger grid investment in China is expected to provide medium-term support.

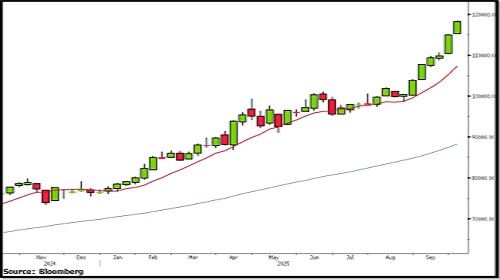

MCX Gold

Technical Outlook:

MCX Gold posted a strong 6% gain last week, marking its sixth consecutive weekly advance since Aug’25. However, both the weekly and daily RSI are trading in extremely overbought territory, indicating potential risk at current levels. On the weekly chart, the price structure continues to form higher highs and higher lows. Sustained trade above Rs 1,18,500 could extend the uptrend towards the next resistance levels at Rs 1,21,500 and Rs 1,23,000. On the downside, strong support lies at Rs 1,15,000. A decisive break below this level may trigger a deeper correction, with downside targets seen at Rs 1,10,000 and Rs 1,08,000.

Recommendation:

We recommend buying MCX Gold above Rs 1,18,500, with a stoploss below Rs 1,16,000 and targets of Rs 1,21,500 and Rs 1,23,000.

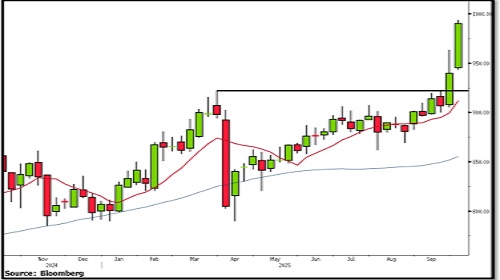

MCX Silver

Technical Outlook:

MCX Silver gained nearly 2.7% last week, extending its winning streak to seven consecutive weeks. On the weekly chart, the price continues to maintain a higher highs and higher lows formation, reflecting a sustained upside trend. However, the weekly RSI at 82 signals extremely overbought conditions, warranting cautious action. A sustained move above Rs 1,47,000 could extend the rally towards the next resistance zones at Rs 1,52,000 and Rs 1,55,000. On the downside, strong support is placed at Rs 1,42,000. A decisive break below this level may shift the trend from positive to negative, opening the way for declines towards Rs 1,41,000 and Rs 1,38,000.

Recommendation:

We recommend buying MCX Silver above Rs 1,47,000, with a stop loss below Rs 1,43,000 and targets of Rs 1,52,000 and Rs 1,55,000.

Current market price (CMP): Rs 1,45,744

MCX Crude Oil

Technical Outlook

MCX Crude Oil declined nearly 7% last week, briefly breaching the consolidation range support at Rs 5,400, but managed to close above this key level, indicating some resilience. On the daily chart, the price has slipped below the 100-SMA, indicating weakness and signalling further downside pressure. Going forward, sustained trade below Rs 5,400 could trigger fresh short build-up, opening the way for declines towards Rs 5,100 and Rs 4,900. On the higher side, strong resistance is seen at Rs 5,600.

Recommendation:

We recommend selling MCX Crude Oil below Rs 5,400, with a stop-loss above Rs 5,600 and targets of Rs 5,100 and Rs 4,900.

Current market price (CMP): Rs 5,444.

MCX Copper

Technical Outlook:

MCX Copper gained over 5% last week, closing at a fresh alltime high. The uptrend strengthened after the price broke above the key resistance level of Rs 947, with the chart pattern continuing to show higher highs and higher lows, confirming bullish momentum. A breakout above Rs 995 could further extend the rally towards Rs 1,030 and Rs 1,050. On the downside, strong support is placed at Rs 940. A decisive break below this level may trigger a corrective move, with downside targets at Rs 910 and Rs 900

Recommendation:

We recommend buying MCX Copper above Rs 995, with a stoploss below Rs 965 and targets of Rs 1,030 and Rs 1,050

Current market price (CMP): Rs 990.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)