Vikran Engineering Reports 17% Revenue Growth, 61% EBITDA Surge in Q1 FY26

Vikran Engineering Limited (“Company”), one of India’s fast-growing EPC companies with presence across Power Transmission & Distribution, EHV Substation, Railway and Metro Electrification, and Water Segment today announced its un-audited financial results for the first quarter ended June 30th, 2025.

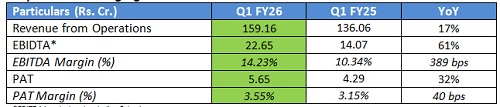

Key Consolidated Highlights:

Performance Highlights for the first quarter ended 30th June 2025:

* Revenue from Operations stood at Rs. 159.16 crorecompared to Rs. 136.06 crorein Q1 FY25, an increase of 17%. This was led by effective execution of orders acrossdiversified portfolio.

* EBITDA for the quarter stood at Rs. 22.65 crore compared to Rs. 14.07 crore in Q1 FY25, registering a robust increase of 61%. EBITDA Margins grew by 389 bps to 14.23% compared to 10.34%in Q1 FY25

* PAT stood at Rs. 5.65 crore, an increase of32% on YoY basis. PAT margins increased by 40 bps on YoY basis

Operational Highlights:

* “Order Book: As of June 30, 2025, the order book stood at Rs. 5,120.21 crore, of which Rs.2,442.44crore is executable, providing strong revenue visibility. The Company has delivered a robust growth trajectory with a CAGR of over32% in the last three years, and is on track to achieve even better growth backed by favourable market conditions and its diversified execution capabilities.”

Key Projects:

* Progress in large-scale water supply projects under the Jal Jeevan Mission across Uttar Pradesh, Madhya Pradesh, and Chhattisgarh.

* Execution of 132 kV traction substation and underground EHV cabling projects under the railway vertical.

* Ongoing smart metering and solar EPC projects.

Commentingon the overall performance of the Company,Mr.Rakesh Markhedkar,Chairman & Managing Director,Vikran Engineering Limited said,

“We are delighted to present our first quarterly results as a listed company. The strong financial performance reflects our disciplined execution, cost efficiency, and diversified project portfolio. With a robust order book and proven capabilities in power, water, and railway infrastructure, we are well-positioned to capture emerging opportunities in India’s infrastructure growth story.”

Above views are of the author and not of the website kindly read disclaimer

600-400.jpg)