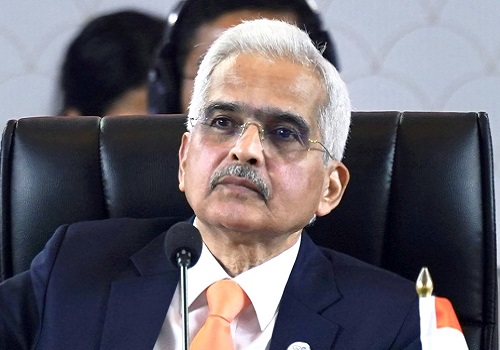

Urban cooperative banks should work towards improving gross NPAs ratio: Shaktikanta Das

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Urging lenders to improve the governance standards, avoid related-party transactions and focus on credit risks, the Reserve Bank of India (RBI) Governor Shaktikanta Das has said the central bank is not comfortable with the gross non-performing assets (GNPAs) ratio of 8.7 per cent in urban cooperative banks (UCBs) and asked them to work towards improving the same.

Governor said the overall GNPAs have improved to 8.7 per cent, which is not a good number. It is not a comfortable number even at an aggregate level. Scheduled commercial banks' GNPAs stood at a decadal best level of 3.9 per cent in March 2023 and are widely estimated to improve further. To manage the scourge of NPAs better, Das suggested that there should be a focus on credit risk management with better underwriting.

Das said the RBI has come across instances of conflicts of interest or related party transactions, which need to be avoided, adding that similarly, there have been instances of many of the top defaulters being individuals or businesses having the ability to pay. He further noted that the top 20 defaulters account for over 60 per cent of the loan overdue, and focusing on this segment can help improve the overall NPAs.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">