The Price of Faith: Why Gold Still Shines and Silver Once Again Surges: MP Financial Advisory Services LLP

The Festive Glow and the Price of Aspiration

As India steps into the festive season of Diwali, gold and silver once again take centre stage, not only as adornments of tradition but also as indicators of economic sentiment. In 2025, the glimmer of these metals tells a nuanced story: one of sustained global uncertainty, resilient domestic demand, and a shifting balance between affordability and aspiration.

The Journey So Far

Over the last five years, global precious-metal prices have climbed steadily, reflecting a world grappling with inflation, currency adjustments, and persistent geopolitical flux. Between November 2022 and October 2025, gold surged from about $1,900/oz to nearly $3,850/oz, while silver rose from $24/oz to around $47/oz—albeit with far greater volatility. This period also marked a renewed institutional embrace of gold as a strategic reserve asset. As of June 2025, the United States remained the largest holder of official gold reserves with 8,133 tonnes, followed by Germany (3,350 t), Italy (2,452 t), France (2,437 t), and Russia (2,330 t). Among emerging markets, China (2,299 t), India (880 t), and Turkey (635 t) have been active accumulators, underlining a gradual diversification away from the U.S. dollar. Together, these holdings have reinforced gold’s re-monetisation as a store of value within central-bank balance sheets, sustaining demand even at record price levels.

India’s own appetite for gold has mirrored this global trend. Imports rose sharply from $34.6 billion in FY21 to $58 billion in FY25, highlighting both cultural affinity and household resilience. Silver imports too have expanded, reflecting its growing relevance as an industrial and investment metal within the renewable-energy and electronics value chains.

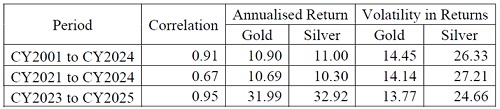

Viewed through a long-term lens, gold and silver have largely advanced in tandem, reflecting their intertwined roles as monetary anchors and indicators of global liquidity. Since the early 2000s, both have been influenced by the same macro undercurrents - cycles in the U.S. dollar, inflation expectations, and shifts in global risk sentiment - resulting in broadly parallel price trajectories despite differing market structures.

In recent years, however, their paths temporarily diverged as underlying drivers evolved. Gold’s ascent was anchored in sustained central-bank accumulation and its renewed role as a hedge against policy and geopolitical uncertainty. Silver, by contrast, oscillated between phases of industrial revival and speculative corrections, revealing its growing dependence on the fortunes of manufacturing, solar energy, and electronics. This phase underscored how gold’s strength has increasingly come from monetary stability, while silver’s has stemmed from industrial dynamism.

By late 2023, the relationship between the two metals had tightened once more. Both benefited from synchronised monetary easing, persistent geopolitical risk, and expanding investment flows into tangible assets. This alignment strengthened dramatically in 2025, as gold prices surged from around $2,650 per oz in January 2025 to nearly $3,860 per oz by October 2025, a rise of almost 45% within ten months, while silver jumped from $29 to over $47 per oz, its highest level in more than a decade, though silver had previously tested this level in 1980 and again in 2011. The rally reflected a confluence of forces: higher expectations from US rate cuts, sustained central-bank buying, and industrial restocking across solar and electronics supply chains. Gold reaffirmed its position as a stable store of value amid macro flux, while silver amplified the momentum as the cyclical bellwether of a broader industrial revival.

The Festive Demand Pulse

Despite higher prices, retail demand ahead of Diwali remains buoyant, with an indication of a shift in buying patterns rather than a withdrawal. Consumers are increasingly:

* Opting for lighter, lower-karat designs, balancing tradition with affordability.

* Leveraging exchange and old-gold programs to mitigate costs.

* Experimenting with digital gold and sovereign gold bonds, allowing participation without heavy upfront outlays.

Silver, meanwhile, is gaining ground as a symbolic and practical substitute. Beyond its decorative appeal, the industrial demand linked to solar panels, electronics, and electric mobility adds fundamental support to prices, creating a dual-use demand base that gold lacks. Yet, for many Indian households, the question is no longer whether to buy gold, but how much, and in what form.

Is Gold Becoming Out of Reach?

It is tempting to say so. At over Rs.1 lakh per 10 grams, gold has moved beyond the comfort zone of many middle-income households. Yet, history shows that gold in India is not just a commodity; it is a cultural and psychological store of value. When prices soar, Indians don’t abandon gold; they adapt their approach. The metal’s symbolic role in weddings, savings, and festive gifting ensures that even as purchases become smaller, participation persists. What is likely to evolve is how gold is owned, not whether it is. The shift from physical jewellery to paper or digital gold and the growing acceptance of exchange-based savings schemes suggest that the idea of owning gold is being redefined, from ornamental to strategic.

What’s in Store for Diwali and Beyond: FY2026 Outlook

As the diyas light up this Diwali, gold may appear expensive, yet it remains far from unattainable. Its appeal lies not merely in its shine but in its resilience, a reflection of enduring faith and financial continuity for millions of Indians. The festive spirit underscores a deeper truth: gold continues to serve as both an emotional anchor and a strategic hedge, while silver has emerged as a symbol of industrial optimism and affordability. Looking beyond the festival, market realities have already outpaced earlier forecasts. Most projections made in early 2025 expected gold to stabilise near $ 3,400–3,600 per oz by FY2026, yet prices touched $ 3,858 per oz in October 2025, driven by renewed safe-haven demand, sustained central-bank accumulation, and expectations of further U.S. rate cuts. Silver too exceeded expectations, crossing $ 47 per oz on renewed industrial restocking in solar and electronics.

Going forward, analysts anticipate a phase of consolidation rather than another sharp rally, with gold likely to hover between $ 3,700–3,900 per oz and silver in the $ 44–50 per oz range through FY2026. However, according to the World Gold Council’s June 2025 report, a majority of respondents (73%) expect the share of U.S. dollar holdings in global reserves to decline over the next five years, while allocations to other currencies—such as the euro and renminbi and to gold are likely to increase. This raises an important question: will the narrative now shift from “How much higher can gold go?” to “How long can it sustain these levels?”

According to MPFASL, they believe that while gold may not replicate its stellar YTD 2025 performance, its upward trajectory is far from over. The rise has entered a phase of structural endurance rather than speculative exuberance. As for silver, history offers a fascinating perspective. Since 1980, it has touched the $ 50 per oz mark three times, each time retreating thereafter. With 2025 marking its third such milestone, the question now is whether silver can finally build sustained momentum and move toward the next big landmark, its metaphorical “century”. Time and industrial demand will tell. MPFASL says, thanks to industrial demand, it has the required merits to cross over $50 mark, this time.

Above views are of the author and not of the website kindly read disclaimer