The index opened on a gap-up note and initially attempted to test the key resistance at 25,000 - GEPL Capital Ltd

Market News:

* Tata Elxsi has inaugurated a global technology centre for medical devices in Pune, strengthening its position in healthcare innovation.

* Actively managed equity mutual funds saw inflows of Rs.33,430 crore in August, down 22% from Rs.42,702 crore in July, according to AMFI data.

* Andhra Pradesh government has cleared the allotment of 26.7 acres of land to Syrma SGS Technology for setting up a new manufacturing facility.

Technical Summary:

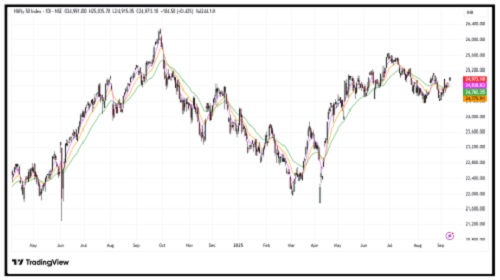

The index opened on a gap-up note and initially attempted to test the key resistance at 25,000. However, it soon encountered selling pressure and drifted lower to record a day’s low at 24,915. On the sectoral front, Nifty IT and PSU Bank emerged as the top performers, while Auto and Media sectors underperformed.

Levels to watch:

The Nifty has its crucial resistance 25000 (Pivot Level) and 25150 (Key Resistance). While support on the downside is placed at 24900 (Pivot Level) and 24800 (Key Support).

What should short term traders expect?

The Index can short below 24800 for the potential target of 24700 with stop loss of 24870 level.

Technical Data Points

NIFTY SPOT: 24979 (0.44%)

TRADING ZONE:

Resistance: 25000 (Pivot Level) and 25150 (Key Resistance).

Support: 24900 (Pivot Level) and 24800 (Key Support).

STRATEGY: Bearish till below 25150 (Key Resistance).

BANK NIFTY SPOT: 54536 (0.59%)

TRADING ZONE:

Resistance: 54800 (Pivot Level) / 55300 (Key Resistance)

Support: 54200 (Pivot Level) / 53700 (Key Support)

STRATEGY: Bearish Till below 55300 (Key Resistance)

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer