The Bank Nifty demonstrated robust recovery on renewed optimism over a potential US -India trade pact - ICICI Direct

Nifty :25062

Technical Outlook

Day that was…

Indian equity benchmarks staged a strong recovery, following the comment by US President Donald Trump on US-India trade deal. The Nifty settled at 25062, up 1.60%. Sequential improvement in market breadth over the past four days with an A/D ratio of 2:1, points to growing bullish sentiment and broader market support. The Midcap & Small cap index closed positive ~0.50+% for the day. Sectorally, all sectors closed in green where, Auto, Realty and Metal outperformed

Technical Outlook:

* The index witnessed flat to positive opening after an initial decline supportive efforts in the vicinity of Wednesday session’s low index staged a strong recovery. This led to the formation of a sizeable bull candle. Meanwhile, India VIX witnessed a decline of 2%, closing at 16.89 (below 17), further reinforcing the strength of the prevailing up trend.

* Key point to highlight is that Nifty reclaimed 25000 mark for the first time since 15th Oct 2024 with above average volume (1lacs crs average), indicating continuation in upward momentum. The formation of higher peak and trough supported by across sector participation signifies strength that opens the door for 25500 levels in coming weeks as it is 80% retracement of the fall (26277-21743) as index witnessed breakout from past three weeks consolidation (24500-23800). Further, the index witnessed a faster pace of retracement as entire sixteen-week decline (24,800 to 21,750) has been fully retraced in just six weeks. The faster pace of retracement, backed by broadbased sectoral participation, underscores a structural turnaround, prompting us to revise the support base higher to 24,400. Our positive view is further validated by the following observations:

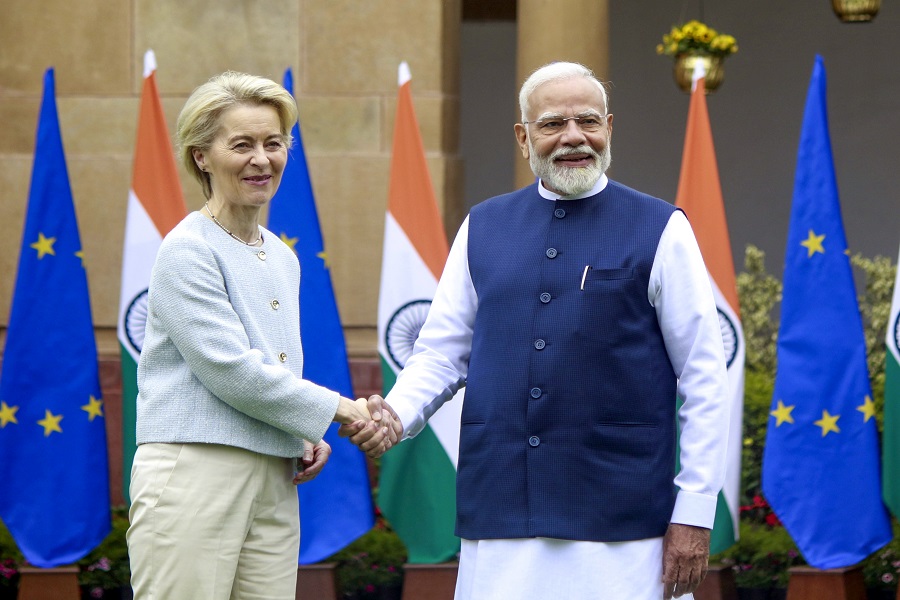

* a) Bilateral Trade Agreement between India and US would boost the market sentiment.

* b) Positive FIIs flows bodes well for Indian equities.

* c) Cool off in Brent crude oil prices, weakness in US Dollar index and US Bond yields would provide further cushion to domestic market.

* Mirroring the benchmark move, Nifty midcap and small cap indices have staged a strong rebound and logged a breakout from tree months base. The Midcap and small cap index witnessed a strong recovery of 21% and 23% from March lows after retesting multi-year resistance trend line. Historically, maximum average correction in Midcap and small cap indices have been to the tune of 27% and 29% while time wise such correction lasted for 8 months. Subsequently, both indices have seen 28% returns in next six months. Further, market breadth has also improved from previous sessions notably, with 87% of Nifty 500 stocks now trading above their 50-DMA and 39% above their 200-DMA compared to April month’s lowest reading of 27 and 15 respectively, clearly indicating improvement in market breadth.

* The breakout from three weeks consolidation confirms resumption of uptrend that makes us revise support base at 24400 as it is 50% retracement of recent rally (21743-24944)

Nifty Bank : 55356

Technical Outlook

Day that was :

The Bank Nifty demonstrated robust recovery on renewed optimism over a potential US -India trade pact . The index settled on a positive note at 55355 , up by ~ 1 % . The Nifty PSU Bank index after four consecutive sessions of outperformance taken a breather and settled at 6621 .65 , up by 0 .18 % .

Technical Outlook :

* The Bank Nifty opened flat to positive and after initial decline buying demand emerged in the vicinity of Wednesday session’s low where index rebounded significantly . This price action resulted in the formation of a sizeable bull candle, signaling revival in upward momentum .

* After past two sessions of breather, the index closed above the previous week’s high, signaling a continuation of the uptrend . Key point to highlight is that, index has resumed its uptrend after three weeks slower pace of retracement, highlighting robust price structure that makes us revise our target to 57000 which is external retracement of the fall from (56098 -53483 ) the strong support is placed at 53500 which is recent swing low which coincides with 38 .20 % retracement of the recent up -move (49156 -56098 ) . Hence, any decline from hereon would lead to higher base formation that would set the stage for next leg of up move .

* Structurally, the Bank Nifty is witnessing elongation of rallies followed by shallow retracement which signifies robust price structure as the recent up -move is larger (14 % ) as compared to that observed in previous month ( 9 % ) . Additionally, the declines are getting shallower as the recent decline is of 4 . 6 % as compared to 5 . 6 % observed in Mar - 25 . Moreover, the Bank Nifty is showing resilience as compared to the benchmark as it witnessed faster pace of retracement where it regained previous 6 months of decline in less than 2 months, indicating structural turnaround . Furthermore, the index broke out of an eight -month falling trendline and surpassed its lifetime high, indicating robust structure .

* Mirroring the benchmark index, the Nifty PVT Bank index too regained momentum and closed above previous week’s high indicating, a decisive shift in market sentiment toward optimism . Further, the underlying price structure emerging form a three -week consolidation phase resembling a bullish flag remains firmly intact . We anticipate a breakout from this formation, with the index gradually progressing towards the recent swing high of 28050 . Meanwhile, the immediate support on the downside is placed at 26700 mark, being 38 .20 % retracement mark of the recent up -move (24400 -28050 ) .

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631