Technical Morning Ideas : BankNifty would have the daily range of 50800-51800 levels by Vaishali Parekh, Prabhudas Lilladher Pvt Ltd

NIFTY / SENSEX

Nifty, after failing to capitalise on the positive opening session, was subjected to profit booking to cool off after the strong rally witnessed in the last one week to end the session near 23500 zone with bias still maintained positive as of now. The index would have the crucial and major support zone near 23000 zone with the 50EMA positioned near 23100 levels and would need to sustain above this indicator to maintain the overall sentiment intact. Sensex witnessed a bearish candle with profit booking seen to touch the crucial support zone of 77200 level during the intraday session but managed to close near 77250 levels with bias and sentiment maintained with a very cautious approach as of now. The index needs to sustain the 78300 zone, failing which the index can drag further to retest the 50 EMA level at 76150 zone. The support for the day is seen at 23300 levels while the resistance is seen at 23700 levels.

BANKNIFTY / BANKEX

BankNifty, witnessed a gradual slide during the intraday session to end near the 50200 zone with the near-term support maintained near the important 200 period MA at 51000 zone and with overall bias maintained intact, we can anticipate a further revival in the coming days provided the significant 100 period MA at 50350 level is sustained as of now. Bankex gave in with selling pressure witnessed losing almost 600 points to end near the 58930 zone with bias turning weak having the near-term support at 200 DMA level of 58070 which needs to be sustained failing which the 50 EMA level of 57500 can be retested in the coming days. The 59800 zone has been acting as the tough barrier on the upside and only a decisive breach above the 60000 shall bring conviction and confirm for a fresh upward move in the coming days. BankNifty would have the daily range of 50800-51800 levels.

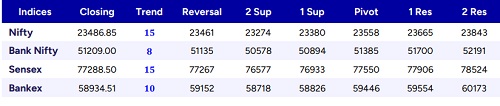

Nifty / BankNifty / Sensex / Bankex - Daily Technical Levels

Above views are of the author and not of the website kindly read disclaimer