Monthly Rollover Report 29th September 2025 by Axis Securities Ltd

NIFTY HIGHLIGHTS

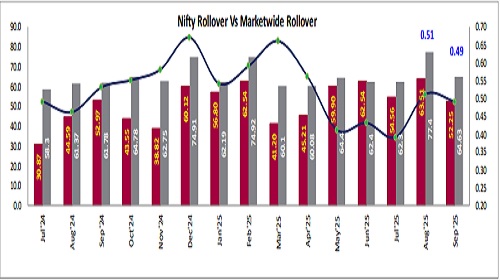

Nifty September rollover stood at 52.3% on Friday, notably lower than the 63.5% observed on the same day of the previous expiry, and also below the three-month average of 60.2% and six-month average of 54.5%, indicating a subdued rollover trend and possibly a cautious undertone among traders regarding positions. Bank Nifty rollover came in at 48.0%, trailing both the previous expiry’s 53.2% and the three- and six-month averages of 51.8% and 53.8% respectively, reflecting a modest decline in rollover interest and hinting at reduced conviction in the banking sector heading into the new series. The rollover cost for September contracts stood at 0.49%, marginally lower than the 0.51%, indicating relatively steady sentiment, with no significant risk premium being priced in by market participants. The Market wide rollover for September was at 64.6%, down from 77.4% a month ago and below the three-month average of 67.4%, though still marginally above the six-month average of 64.4%, suggesting broad-based caution, albeit with stable medium-term rollover behavior. The option data for the September series indicates a strong Call Open Interest (OI) at the 25,000-strike price, followed by 25,100. In contrast, a substantial concentration of Put OI is observed at 24,600, with additional levels at 24,500. This suggests the likely range for the current expiry is between 24,500 and 25,000.

Nifty Rollover Vs Market-wide Rollover

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633