Strong system-wide sales growth of 18.4% YoY along with an increase in consolidated PAT to Rs.979 million in Q2FY26, up 15.3% YoY on an adjusted basis

Travel Food Services Limited (TFS), a leading operator of Travel QSR outlets and Lounges in India, announces its results for the second quarter and the first half-year ended Sep 30, 2025.

Key Highlights

* Strong system-wide sales1 growth of 18.4% YoY in Q2FY26 and 22.4% YoY in H1FY26

* Consolidated PAT growth of 15.3% YoY in Q2FY26 and 17.2% YoY in H1FY26, on an adjusted basis2

* Now operating > 500 Travel QSR outlets and Lounges on a system-wide basis, as of Sep 30, 2025

* New F&B concessions won at Cochin Airport - Domestic terminal and Delhi IGI Airport – Terminal 2, along with good progress on mobilisation of contracts at Noida and Navi Mumbai, to further strengthen our system-wide presence

* Strong financial position with no debt & cash balance3 of Rs. 7,490 million as on Sep 30, 2025

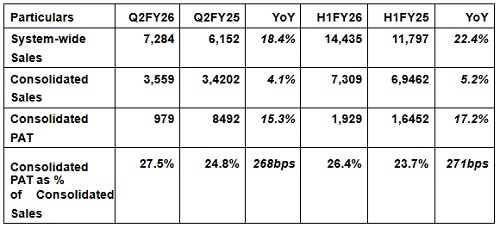

Financial Performance (Rs. Million)

*Q2FY25 and H1FY25 consolidated financials (and therefore consolidated YoY comparisons) are adjusted for the one-time effect of the deconsolidation of the JV business. For more details refer Note 2.

Key Financial Highlights – Q2FY26 & H1FY26

* System-wide Sales increased to Rs.7,284 million (up 18.4% YoY) in Q2FY26 and Rs.14,435 million (up 22.4% YoY) in H1FY26 comprising:

* Like-for-like (LFL)4 sales growth of 9.2% YoY in Q2FY26 and 10.4% YoY in H1FY26 was driven by ongoing revenue enhancement initiatives, such as menu engineering and targeted promotional activities. The performance was achieved despite passenger traffic across the system-wide airports declining marginally by 1% YoY in Q2FY26 and showing a modest 1.8% YoY increase in H1FY26. This was a consequence of the reduced flight schedules due to additional maintenance and safety procedures that followed the tragic aircraft accident in Ahmedabad. Encouragingly, passenger traffic volumes have begun to recover, with momentum gaining pace in recent weeks.

* Net contract gains5 of 9.3% YoY in Q2FY26 and 10.0% YoY in H1FY26 reflected the mobilisation of 50 travel QSR outlets in the last 12 months, mainly in the Mumbai, Delhi, Ahmedabad and Hyderabad airports. Additionally, 4 lounges have been mobilised, with 3 Lounges in India and 1 Lounge in Malaysia.

* Consolidated sales increased to Rs.3,559 million (up 4.1% on an adjusted basis) in Q2FY26 and Rs.7,309 million (up 5.2% on an adjusted basis) in H1FY26 consisting of:

* LFL sales growth of 3.8% YoY in Q2FY26 and 4.7% YoY in H1FY26 which was driven by ongoing revenue enhancement initiatives, despite the temporary slowdown in passenger traffic. For TFS’ consolidated airports, passenger traffic declined 3.5% YoY in the quarter and was broadly unchanged over the first half, for the reasons explained above.

* Net contract gains of 3.4% YoY in Q2FY26 and 0.3% in H1FY26. In the second quarter, net contract gains benefitted from increase in mobilisation of new units at the TFS’ consolidated airports. For the first half, net contract gains were broadly flat, reflecting the expiry of few contracts and subsequent pick-up of new contracts by the joint venture.

* Consolidated PAT increased to Rs.979 million (up 15.3% YoY, on an adjusted basis) with a PAT margin of 27.5% (expanding by ~268bps) in the second quarter of the year and Rs.1,929 million (up 17.2% YoY, on an adjusted basis), with a PAT margin of 26.4% (expanding by ~270bps) in the first half of the year. This increase was achieved through a combination of sales growth, cost efficiency and step up in the share of profit of the associates and joint ventures.

* Our balance sheet remains strong with no debt and a cash balance of Rs.7,490 million.

Impact of the deconsolidation of the JV business

Q2 and H1FY25 adjusted consolidated financials (and therefore YoY comparisons) exclude the one-time impact arising prior to the deconsolidation of the JV, Semolina Kitchens Limited, effective October 14, 2024. Therefore, for FY25, we will continue to adjust for the impact of deconsolidation up to the anniversary i.e., October 14, 2025.

Key Operational Highlights

* Travel QSR Outlets and Lounges

* Brand portfolio has expanded to 135 brands by Sep-25 at a system-wide level, after addition of 16 exciting new brands in the last year.

* As of Sep-25, footprint scaled to 464 Travel QSR outlets (up from 414 as of Sep-24) and 37 Lounges (up from 33 as of Sep-24) across domestic & international airports.

* TFS, in partnership with celebrity chef Gordon Ramsay, unveiled India’s first Gordon Ramsay Street Burger outlet at Delhi’s Indira Gandhi International Airport (T1) in Aug -25.

* New Business

* Awarded a new contract to operate 11 Travel QSR outlets and 1 lounge at Cochin International Airport Domestic Terminal in Sep-25. With this win, TFS will increase its presence to 14 out of 15 top busiest airports in India.

* Elite Assist Technology & Services Private Ltd, a wholly owned subsidiary of TFS, has enabled a technology platform for direct integration with banks & card networks for providing lounge access to their card customers.

* Additionally in Oct-25, contract has been awarded to operate 14 Travel QSR outlets at Terminal 2 of Indira Gandhi International Airport, New Delhi.

Commenting on the Q2 & H1FY26 performance, Mr. Varun Kapur, Managing Director and CEO, TFS, said:

‘This quarter has been marked by robust execution of operations and mobilisation of new sites, taking us over the 500-outlet mark, thereby reinforcing our leadership position in the sector. With our continued focus on driving profitable growth, we delivered a strong financial performance with system-wide sales growth of 18.4% YoY and adjusted consolidated PAT increase of 15.3% YoY in Q2FY26, despite a short-term moderation in passenger traffic. We also successfully enabled a new technology platform, which directly integrates banks & card networks for lounge access to travellers, delivering a seamless experience.

Passenger growth is currently recovering following the temporary slowdown seen since June-25, and we are focused on executing our plans and strategic initiatives to drive business growth, as we enter the seasonally stronger second half. We recently began operations at the reopened Delhi Terminal 2 and are well prepared to commence operations at Cochin International Airport, and the newly built Noida and Navi Mumbai airports.

We are proud of our achievements to date, and we are equally excited about the future & building our business to create value for all our stakeholders.’

Notes:

1. TFS system-wide numbers (including system-wide sales) are based on TFS’ system-wide presence covering TFS, its subsidiaries, associates and joint ventures.

2. Q2FY25 adjusted consolidated sales exclude Rs.1,672 million and H1FY25 adjusted consolidated sales exclude Rs.2,336 million Semolina Kitchens sales, however related party transaction elimination of Rs.87 million and Rs.180 million with Semolina Kitchens has been added back for the respective periods. Similarly, adjusted consolidated PAT excludes net profit of Rs.339 million for Q2FY25 and Rs.72 million for H1FY25 from Semolina Kitchens, but includes profit in proportion to TFS’ current shareholding in the JV (i.e. Rs.85 million and Rs.18 million, respectively).

3. Cash Balance includes Cash and Cash Equivalents, other Bank balances and Current Investments.

4. LFL (Like-for-Like) sales growth refers to growth in revenues generated in the equivalent period of the fiscal year for Travel QSR and Lounge outlets opened for at least 12 months. Revenues in respect of closed outlets (other than temporary closures) are excluded from the calculation. LFL sales growth is calculated as revenue from Travel QSR and Lounge services in a fiscal year minus revenue from Travel QSR and Lounge outlets opened for less than 12 months, divided by the revenue from Travel QSR and Lounge services from the previous period minus the Revenue from Travel QSR and Lounge outlets that were closed during the equivalent period in the previous fiscal year. LFL calculations exclude revenues from management and other services.

5. Net Contract Gains represent revenue in outlets of the Company, and its Subsidiaries/JVs/Associates open for less than 12 months. Prior period revenues for closed outlets are excluded from LFL sales and classified as contract losses. Net Contract Gains are contract gains less contract losses.

Above views are of the author and not of the website kindly read disclaimer