Strategy : FII Monthly Flow Tracker - Nov'25 By JM Financial Services

In Nov’25, both FIIs and DIIs were net buyers (to the tune of USD 40mn and USD 8.7bn respectively) in the Indian equity market. Over last 12 months, the Indian primary markets have seen FII net inflows to the tune of INR 823bn (USD 9.5bn) while secondary markets have seen FII net outflows of INR 2,144bn (USD 24.5bn). In Nov’25, India’s weight in the MSCI Emerging Markets Index was 15.8% vs. 15.2% in Oct’25 and 19.9% in Nov’24.

FIIs remain net buyers for the second consecutive month: In Nov’25, FIIs were net buyers to the tune of INR 3.3bn (USD 40mn) while Nifty rose 1.9% MoM, after a 4.5% rise in Oct’25. FIIs remained net buyers for the 2nd consecutive month. The primary market saw net FII inflows to the tune of INR 119bn (vs. inflows of INR 101bn in Oct’25) while the secondary market saw net FII outflows to the tune of INR 116bn (vs. inflows of INR 9.2bn in Oct’25).

FIIs net buyers in primary and net sellers in the secondary markets over last 12 months: Over last 12 months, the Indian primary markets have seen FII net inflows to the tune of INR 823bn (USD 9.5bn) while secondary markets have seen FII net outflows of INR 2,144bn (USD 24.5bn)

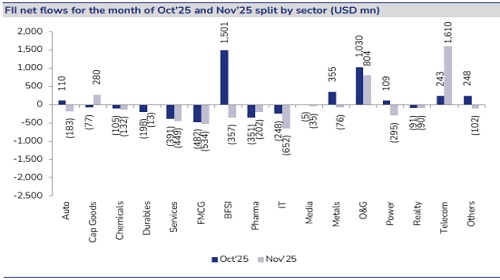

IT, FMCG, Services, BFSI, Power, Pharma, Auto and Chemicals saw the largest FII outflows: Sectors that saw the highest outflows included IT (USD 652mn), FMCG (USD 534mn), Services (USD 449mn), BFSI (USD 357mn), Power (USD 295mn), Pharma (USD 202mn), Auto (USD 183mn) and Chemicals (USD 132mn).

Telecom, O&G and Cap Goods saw FII inflows: Telecom saw inflows of USD 1,610mn in Nov’25, followed by O&G at USD 804mn and Cap Goods at USD 280mn.

Top 5 sectoral holdings unchanged: In terms of equity holdings by FIIs, BFSI, Auto, IT, Oil & Gas and Pharma remained the top 5 sectors. These five sectors in together account for ~60% of FII assets in India. Of these, there was a sequential uptrend in BFSI and O&G while Pharma saw a decrease. Auto and IT were flat. As a % of FII AUC in India, BFSI remained the highest at 32%, rising from 31.7% in Oct’25. FIIs were net sellers of BFSI equities in Nov’25; Auto was the second highest at 7.7%, flat vs. Oct’25. FIIs were net sellers of Auto equities in Nov’25; O&G was the third highest at 7.5%, rising from 6.9% in Oct’25. FIIs were net buyers of O&G equities in Nov’25; IT Services was the fourth highest at 7%, flat vs. Oct’25. FIIs were net sellers of IT Services equities in Nov’25; Pharma was the fifth highest at 6.5%, falling from 6.7% in Oct’25. FIIs were net sellers of Pharma equities in Nov’25.

India’s weight in the MSCI EM Index sees a MoM rise: In Nov’25, India’s weight in the MSCI Emerging Markets Index was 15.8% vs. 15.2% in Oct’25 and 19.9% in Nov’24.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361