Stocks in News & Key Economic Updates 07th January 2026 by GEPL Capital Ltd

Stocks in News

* GODREJ CONSUMER: The company expects a gradual recovery in consumption, with the standalone business on track for double-digit Q3 revenue growth, while the Personal Care segment is likely to grow at mid-single digits, keeping consolidated revenue growth close to double digits.

* ACME SOLAR: The subsidiary received a commissioning certificate from GEDA for 12 MW of its planned 100 MW wind power project.

* JD CABLES: The company received a Rs.244 crore work order for civil and electrical works.

* IRB INFRA TRUST: The company secured a 74.5 km highway project from NHAI and will pay a concession fee of Rs.3,087 crore.

* IEX: The company clarified that it has no undisclosed information, and the share price movement is market-driven, with no adverse order passed in the APTEL hearing.

* SAIL: The company reported a 37% YoY increase in sales to 2.1 million tonnes in December 2025.

* BHARAT FORGE: The company completed the acquisition of 20,580 shares of SPV Sunsure Solarpark Twenty at a premium of Rs.1,240 per share.

* FEDBANK FINACIAL: The company approved the allotment of 20,000 NCDs worth Rs.200 crore on a private placement basis.

* BIOCON: Subsidiary Biocon Biologics will introduce three new oncology biosimilars at a US event.

* MAHINDRA AND MAHINDRA: The company launched the XUV 3XO EV with prices starting at Rs.13.89 lakh.

* AB INFRABUILD: The company secured a Rs.51 crore order for a Railway ROB project.

Economic News

* Easing inflation, strong macros to drive FMCG consumption this year: Fast-moving consumer goods consumption is set for a 5% growth in early 2026. Strong economic indicators and rising demand are driving this positive outlook. Consumers are expected to shop more and opt for premium products as prices stabilize. Leading companies like Marico and Dabur are already seeing early signs of recovery.

Global News

* November CPI softer, but sticky core keeps RBA rate-hike risk alive: Australia’s November CPI rose less than expected, with monthly inflation flat and annual CPI slowing to 3.4%, helped by Black Friday discounts and lower travel -related costs. Clothing, footwear, furnishings, and household equipment prices fell, while recreation and culture costs also eased. Core inflation, however, remained sticky, with the trimmed mean up 0.3% month-on-month, keeping annual core inflation at 3.2%, above the RBA’s 2–3% target. Housing costs rose 1.1%, driven by higher rents and new dwelling prices, showing persistent pressure in key sectors. The Australian dollar dipped briefly but recovered, while three-year bond futures ended slightly lower. Investors see a 33% chance of a February rate hike. Major banks expect a 25 bps increase, citing strong economic capacity. The labour market remains resilient, with unemployment at 4.3%. Headline inflation picked up in Q3, keeping RBA cautious. The upcoming quarterly CPI will be critical for guiding policy.

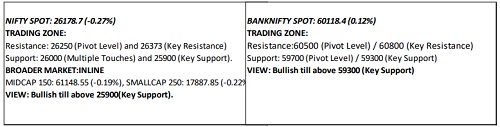

Technical Snapshot

Key Highlights:

Government Security Market:

* The Inter-bank call money rate traded in the range of 4.50%- 5.45% on Tuesday ended at 4.80%.

* The 10 year benchmark (6.48% GS 2035) closed at 6.6137% on Tuesday Vs 6.6331% on Monday

Global Debt Market:

U.S. Treasury yields moved higher on Tuesday, as markets digested heightened geopolitical developments in Venezuela and softer U.S. economic data, with attention shifting toward Friday’s December jobs report. The 10-year Treasury yield added over one basis point to 4.179%. The 2-year Treasury note inched slightly higher by less than 1 basis point to 3.461%. Investors continue to keep an eye on developments in Venezuela after the U.S. carried out strikes on the country over the weekend, resulting in the capture of President Nicolás Maduro and his wife, Cilia Flores, who appeared in court in New York on Monday. Speaking at a news conference on Saturday, President Donald Trump said the U.S. would “run” Venezuela “until such time as we can do a safe, proper and judicious transition.” Global equity and bond markets “took geopolitical developments “in their stride,” Deutsche Bank wrote in a daily report on Tuesday. The MSCI All Country World Index, a measure of global stock market performance, had inched up less than 1%. Meanwhile, economic data showed further weakness in U.S. manufacturing. The ISM index for December slipped to 47.9%, missing expectations. “Taken together, the weaker headline reading, the ongoing decline in employment and the stabilization of price pressures point towards further easing from the Fed this year,” Emirates NBD wrote in a note. The focus later this week will be the jobs report, with economists forecasting 54,000 new jobs added in December. “The employment data will ultimately define the market’s next leg in either a bullish or bearish direction,” said Ian Lyngen, head of U.S. rates strategy in the BMO Capital Markets fixed income strategy team.

10 Year Benchmark Technical View :

The 10 year Benchmark (6.48% GS 2035) yield likely to move in the range of 6.60% to 6.6225% level on Wednesday.

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer