Stocks in News & Key Economic Updates 02nd December 2025 by GEPL Capital

Stocks in News

* BAJAJ FINANCE: Bajaj Finance plans to sell a 2% stake worth Rs.1,740 crore at Rs.96 per share, a 9.6% discount to market price, reducing its current 88.7% holding in the company.

* HERO MOTOCORP: The company posted strong November auto sales with total two-wheeler volumes up 31.5% YoY to 6.04 lakh units, driven by a 92.5% surge in scooter sales and 26.6% growth in motorcycles, while exports jumped 69.1% and domestic sales rose 29.7%, indicating broad-based demand momentum.

* BANK OF MAHARASHTRA: The Government of India will sell a 5% stake in Bank of Maharashtra via OFS, with an additional 1% green shoe option, at a floor price of Rs.54 per share (6% discount), reducing its current 79.6% holding.

* MOIL: The company has raised prices of Mn-44% & above ferro-grade ore, Mn-44% & below ferro-grade ore, and all chemical grade manganese ore by 3%.

* FORCE MOTORS: The company’s November sales rose 52.9% YoY to 2,883 units, driven by a 59.3% surge in domestic sales, while exports fell 20.8% to 118 units.

* NRB BEARINGS: The company has signed a pact with Italy-based Unitec to form a JV for manufacturing cylindrical roller bearings, where it will hold at least a 75% stake in the new entity.

* NMDC: The company’s November iron ore production rose 11% YoY to 5.01 MT, while sales increased 4.3% to 4.17 MT.

* GOPAL SNACKS: The company has begun commercial production at its 63,085 MT namkeen manufacturing facility in Modasa, Gujarat.

* KEI INDUSTRIES: The company has started trial production at its Ahmedabad greenfield unit, with commercial operations scheduled to begin on December 10..

* AMBUJA CEMENT: The company has begun operations at its 4 MTPA clinker unit in Bhatapara, Chhattisgarh, raising its total clinker capacity to 66 MTPA.

Economic News

* Q2 FY26 FDI equity inflows up 20.5% on year: Foreign direct investment equity inflows into India saw a significant jump of 20.5 percent year-on-year, reaching $16.4 billion in the July-September quarter. This growth reflects a positive trend in the first half of the fiscal year. Key sectors like computer software and hardware, services, and trading attracted substantial investments. Maharashtra led the states in receiving the highest FDI..

Global News

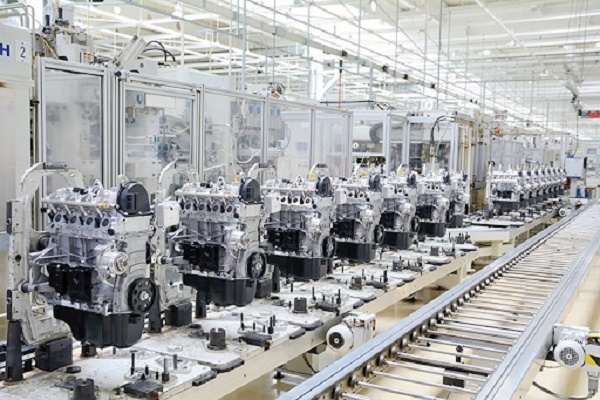

* U.S. manufacturing weakens further as tariffs, costs, and soft demand deepen industry slowdown: U.S. manufacturing contracted for the ninth straight month in November as slumping orders, higher input costs, and persistent tariff pressures continued to weigh on factories. The ISM PMI fell to 48.2, with manufacturers linking layoffs, offshore moves, and weak demand to President Trump’s tariff regime. Only four industries saw growth, while sectors like transportation equipment, wood products, and textiles shrank amid rising costs, supply-chain delays, and economic uncertainty. Tariffs, AI-related confusion, and the recent government shutdown further dampened sentiment, and inflation risks persisted as input prices rose. Employment remained weak for the 10th month, reaffirming subdued factory activity and ongoing stress for blue-collar workers.

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer

More News

Nifty witnessed a relief rally led by banking majors which helped the index fill the gap are...