State Bank of India sees minimal impact of central bank`s tighter rules for personal loans

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

State Bank of India, the country's top lender, expects minimal impact on its capital ratios from the central bank's tighter rules for personal loans, its chairman told Reuters in a phone interview.

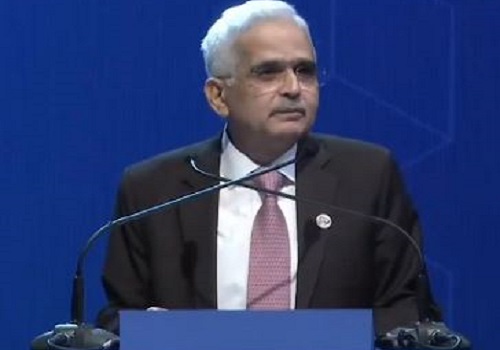

The impact of the increased risk weight on personal loans, including credit cards, will be 55-60 basis points (bps), Dinesh Kumar Khara said on Friday.

SBI's capital adequacy ratio stood at 14.28% as of September end.

"If we take into account the bank's half-yearly profit, which has not yet been adjusted in the capital ratios, then the capital adequacy ratio will rise by 109 bps," Khara said.

Even after accounting for the increased capital requirement, the bank has enough buffers and does not see the need to accelerate fund raising, Khara said.

SBI shares ended 3.6% lower on Friday.

The Reserve Bank of India (RBI) asked banks on Thursday to set aside more capital, following repeated warnings about rapid growth in some personal loans.

Governor Shaktikanta Das had in the recent monetary policy review said banks should strengthen internal processes to curb risks.

The higher capital requirement will make loans costlier and crimp growth, bankers and analysts said.

SBI has already moderated growth in the unsecured personal loans segment, said Khara, who sees the bank maintaining about 15% growth in its retail loan portfolio this fiscal year.

"Capital requirements have not been tightened for car loans, home loans, gold loans ... So core sectors responsible for growth in the economy are untouched," Khara said, adding that he does not expect the central bank to tighten capital requirements for any of these segments.

However, loans provided through digital lenders for short-term consumption could face a slowdown, he added.

SBI Cards and Payment Services , a subsidiary of SBI focused on credit cards, will see a larger impact on its capital ratios.

The impact could be about 400 bps on its capital ratio, Khara said.

Still, its capital ratio would be about 17-18%, which is above the regulatory requirement of 15%.

The board of SBI Cards will take a call on whether there is a need to raise additional capital, he said.

Shares of SBI Cards fell over 5%.