Spot Gold may rise further on safe haven demand and rate cut optimism -ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to hold its gains and move higher on safe haven demand and rate cut optimism. Further renewed concerns over bad debt in US regional banks heightened broader credit market stress. Additionally, dovish comments from the US Fed members fueled the bets of loose monetary policy from the US Fed. Concerns over US labor market and steady inflation numbers has pushed the prospects of two rate cuts in this year. Prices would also get support from economic uncertainty and extension in US Government shutdown which could bring more inflows via ETFs.

* Spot gold is likely to move higher towards $4400, as long as it holds above $4250. MCX Gold December is expected to rise towards Rs.132,500 level as long as it holds above Rs.127,400 level.

* MCX Silver Dec is expected to correct towards Rs.162,000 level as long as it trades under Rs.170,000 level. An increase in additional margin by MCX could bring an immediate correction in price.

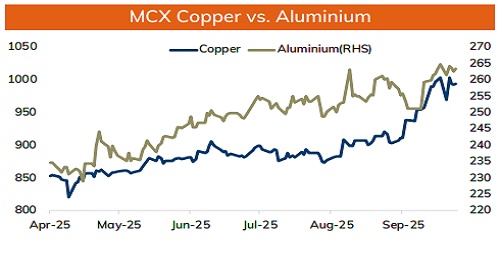

Base Metal Outlook

* Copper prices are expected to hold its ground and trade with positive bias amid supply concerns. Prices will get support from the weaker dollar and increasing prospects of US Fed rate cut. Dovish comments from the US Fed chair Jerome Powell and other Fed members have increased the probability of 2 rate cuts in this year. Further, depleting inventory levels in LME and SHFE would also support the red metals to regain its strength. Meanwhile, uncertainty over US-China trade negotiations and recent US debt concern in the regional banks might weigh on metal prices.

* MCX Copper Oct is expected to hold support near Rs.980 and move back towards Rs.1005 level.

* MCX Aluminum Oct is expected to rise towards Rs.267 level as long as it stays above Rs.261 level.

* MCX Zinc Oct looks to rise towards Rs.294 as long as it holds key support at Rs.288. Only below Rs.288 it would correct towards Rs.285.

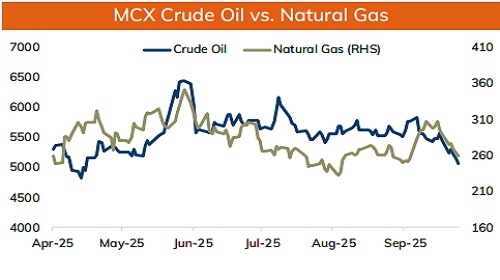

Energy Outlook

* NYMEX Crude oil is likely to remain under pressure amid uncertainty over US-China trade negotiations. Further oversupply concerns would weigh on prices to trade lower. The International Energy Agency has increased its global oil surplus to 4 million barrels per day in the next year. Meanwhile, reports of a possible meeting between Donald Trump and Putin could ease tension between Ukraine and Russia leading to improve in oil supplies. In addition to that US Government shutdown and renewed debt concerns would weigh on oil prices. On the other hand, UK’s sanction on Russia’s oil sector could limit its decline.

* MCX Crude oil Oct is likely to slip towards Rs.4900, as long as it trades under Rs.5180 level. NYMEX crude oil is likely to move towards $55, as long as it trades under $59 per barrel.

* NYMEX Natural Gas is expected to trade lower amid mild US weather forecast. MCX Natural gas Oct is expected to slip towards Rs.254 level as long as it trades under Rs.270 level.