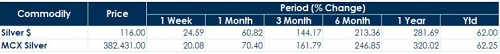

Silver`s Inflection Point: Macro Stress Meets Technical Breakout by Kedia Advisory

Key Highlights

* Silver witnessed extreme intraday volatility in global markets

* Prices surged from $104 to $117.73, then crashed below $102

* Sharp move occurred without any negative fundamental trigger

* Physical market tightness continues despite futures volatility

* Rising speculation and leverage driving “mania-like” behaviour

* Investors advised caution as corrections can be sudden and deep

An Extraordinary Trading Session

Silver markets experienced one of their most volatile sessions in recent history, underlining how quickly a commodity boom can transition into commodity mania. During the session, silver prices opened near $104 per ounce, surged sharply to a lifetime high of $117.73, and then collapsed to an intraday low of $101.98. A nearly $16 swing within a single trading day is highly unusual for a precious metal and reflects a market increasingly driven by sentiment and positioning, rather than incremental changes in fundamentals.

Fundamentals Remain Supportive, But Prices Ran Ahead

Silver’s broader rally continues to be supported by strong structural fundamentals. Global mine supply growth remains constrained due to limited new investments and declining ore grades, while industrial demand from solar energy, electronics, electric vehicles, and power infrastructure continues to rise steadily. However, the pace of the recent price rise far exceeded the speed at which fundamentals typically evolve. This attracted aggressive speculative participation, particularly in futures markets, pushing prices into overextended territory and increasing vulnerability to sharp corrections.

Physical Market Stress Added to Volatility

Beyond futures-market activity, developments in the physical silver market also played a role in amplifying volatility. Deliverable inventories remain tight, and physical availability continues to face constraints due to steady industrial offtake and limited supply flexibility.

Importantly, physical premiums remained firm across several regions despite sharp intraday price swings, indicating that end-user demand did not weaken alongside futures prices. Fabricators and long-term buyers continued to secure metal, highlighting a growing divergence between paper price volatility and physical market reality.

This interaction between physical tightness and speculative futures activity has made price movements sharper and less predictable.

Key Levels Define a High-Risk Zone

After the sharp correction, silver has stabilised near $113–114, but remains in a high-risk trading zone.

* Immediate resistance: $117.70–128.40

* Near-term support: $105.00–107.00

* Critical support: $101.50–102.00

* Healthy corrective zone: $86.40–92.

Such wide gaps between support and resistance reflect elevated volatility, typical of markets entering a speculative phase.

Boom Turning Into Mania

Historically, commodity cycles often move from fundamental-driven rallies into mania-driven price action, where volatility spikes and corrections become disproportionately large. Silver’s recent behaviour fits this pattern, where belief and momentum temporarily overshadow balance and valuatio

In this phase, both upside and downside risks rise sharply, making aggressive positioning increasingly dang

Caution Is Now Essential

Silver’s recent price action is a clear signal that the market has entered a mania-like phase, where volatility is extreme and corrections can be sudden, deep, and unforgiving. While long-term fundamentals remain constructive, short-term positioning—whether long or short—carries elevated risk. Investors are advised to remain cautious, reduce leverage, and avoid chasing price moves. In commodity manias, rallies can be spectacular, but corrections often arrive faster and deeper than expected. Discipline and risk management, rather than conviction alone, are now critical in navigating the silver market.