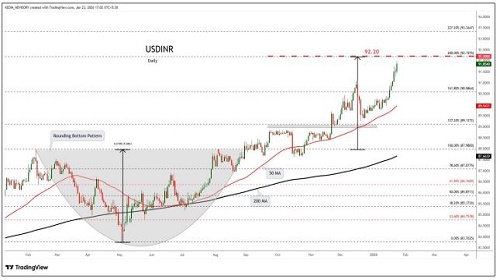

SELL USDINR FEB @ 92.15 SL 92.3 TGT 92-91.9. - Kedia Advisory

USDINR

SELL USDINR FEB @ 92.15 SL 92.3 TGT 92-91.9.

Observations

USDINR trading range for the day is 91.54-92.34.

Rupee closed weaker on dollar demand linked to maturing non-deliverable forwards positions and month-end importer demand.

Rupee faces challenges amid persistent foreign selling of domestic equities exceeding $3.6 billion so far this month.

The industrial production in India rose by 7.9% from the previous year in December of 2025.

EURINR

SELL EURINR FEB @ 110.5 SL 110.8 TGT 110.2-110.

Observations

EURINR trading range for the day is 109.37-111.01.

Euro gains buoyed by broad-based US dollar weakness ahead of the Fed’s closely watched policy announcement.

ECB may need to consider another interest rate cut if further gains in the euro begin to weigh on the bank's inflation outlook.

Germany’s GfK Consumer Climate Indicator rose to -24.1 heading into February 2026 from a near two-year low of -26.9 in the prior period.

GBPINR

SELL GBPINR FEB @ 127.2 SL 127.5 TGT 126.9-126.6.

Observations

GBPINR trading range for the day is 125.63-127.55.

GBP rose supported by a weaker US dollar and signs of accelerating price pressures in the UK.

Data from the British Retail Consortium showed shop prices rose 1.5% year on year in January, the sharpest increase since February 2024.

US President Donald Trump threatened higher tariffs on South Korean goods, following similar warnings to Canada and Europe.

JPYINR

SELL JPYINR FEB @ 60.5 SL 60.7 TGT 60.3-60.1.

Observations

JPYINR trading range for the day is 59.55-61.29.

JPY rose amid mounting speculation of a joint foreign exchange market intervention by Tokyo and Washington.

BOJ minutes showed board members favored continued rate hikes if the outlook for growth and prices holds, while keeping an overall accommodative stance.

On inflation, most members expected core CPI to slow below 2% through the first half of fiscal 2026.