Rupee Report On 04 Dec 2025 by Kedia Advisory

Rupee Outlook

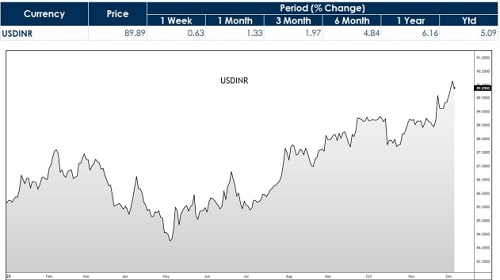

Rupee Clocks 90: What’s Driving India’s Biggest Currency Shock in Years?

The Indian Rupee has breached the Rs.90 per US Dollar mark for the first time in history, signalling one of the sharpest depreciation phases in modern India. This fall comes despite India maintaining strong domestic fundamentals—robust 8.2% GDP growth, healthy banking stability, and resilient consumption demand.

The paradox is clear:

Why is India’s economy strong but its currency weak?

The answer lies in external vulnerabilities, not domestic weakness. Rising trade deficits, falling foreign investment, tariff disadvantages, and global monetary pressures have pushed the rupee into a structural depreciation cycle. A powerful rounding-bottom breakout on the USDINR chart now targets 91.50, with a potential extension higher if global risks persist.

Key Highlights

* Rupee breaches 90 as global uncertainty drives sharp foreign investor withdrawals.

* Trade deficit hits record levels, reflecting India’s deep structural import dependence.

* High US tariffs and missing trade deal weaken India’s export competitiveness severely.

* FDI slowdown intensifies external pressure despite strong domestic economic performance.

* USDINR weekly breakout projects upside toward 91.50 in coming months.

Rupee Depreciation: The Bigger Picture

Monthly Fall (1.2%): The rupee declined 1.2% last month driven by FPIs exiting India, rising importer hedging costs, and renewed geopolitical tensions. This marks the early stage of a deeper depreciation phase. Yearly Fall (5.8%): A 5.8% annual decline reflects pressure from widening trade gaps, elevated import costs, and strong global dollar demand—showing external factors overpower domestic resilience. Five-Year Fall (23%): Over five years, the rupee has dropped 23%, highlighting India’s structural issues: high oil dependency, tariff disadvantages, and limited export diversification. Ten-Year Fall (40%): The decade-long 40% depreciation illustrates chronic vulnerabilities—high deficits, volatile capital flows, and repeated global dollar rallies—demonstrating long-term systemic weakness.

Core Drivers Behind the Rupee’s Decline

Trade Flow Imbalances: India’s import-heavy economy—dominated by crude oil, electronics, gold, and machinery—creates persistent and rising dollar demand. When imports consistently exceed exports, the rupee faces long-term depreciation pressure. Capital Flow Weakness (FPI + FDI): Foreign Portfolio Investors are withdrawing due to global risk-off sentiment. Meanwhile, net FDI is at its lowest since 1990. Reduced foreign investment weakens dollar supply and hurts currency stability. Global Interest Rate Pressures: Higher US interest rates create a strong pull for global capital into US bonds, strengthening the dollar and weakening emerging market currencies like the rupee. External Imbalances (CAD + BoP): India’s Current Account Deficit is expected to widen from $23B to $55B by FY26. Persistent deficits increase dollar demand, deepening rupee pressure regardless of domestic growth.

WHY the Rupee Is Falling

Record Trade Deficit: India’s trade deficit hit an unprecedented $41 billion in October.

Key contributors:

* Higher crude oil and gold imports

* Heavy electronics demand

* Weak global exports

Higher deficit → More dollars needed → Weaker rupee.

Foreign Investor Exodus

FPI selling intensified as global yields rose, causing rupee outflows. When investors sell Indian assets, they convert rupees into dollars—directly weakening the INR.

Above views are of the author and not of the website kindly read disclaimer