Rupee caught between dollar uptick, central bank intervention

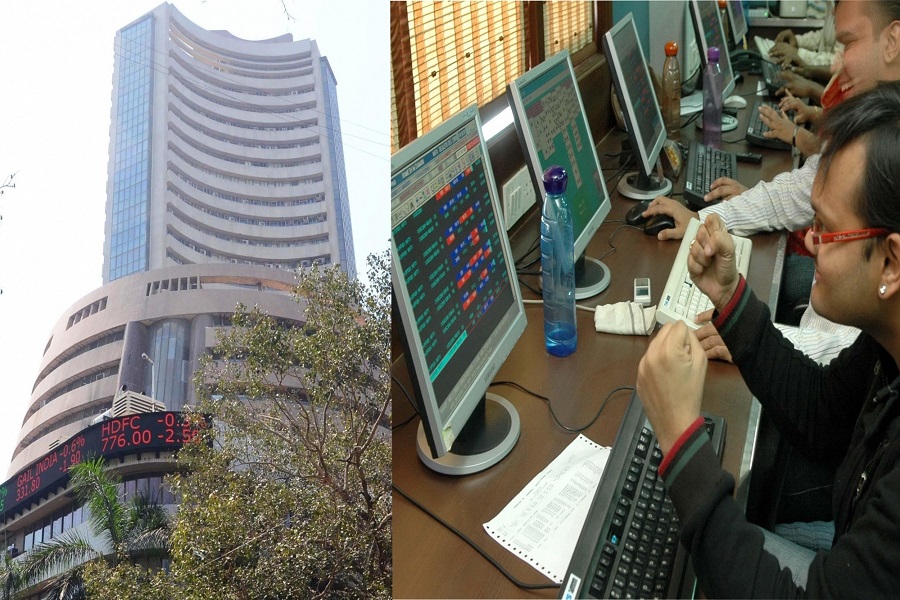

The Indian rupee is expected to open flat on Tuesday amidst weakness in Asian peers on one hand and a central bank that does not want the currency to fall to an all-time low on the other.

Non-deliverable forwards indicate the rupee will be mostly unchanged from the 83.5050 of the previous session.

The dollar was largely bid, following through on robust U.S. jobs data that decreased the odds of the Federal Reserve cutting interest rates later this year. Asian currencies were down 0.1% to 0.3%.

The Fed's two-day policy meeting begins later in the day, following which it is widely expected to make no changes to the policy rate. The Fed's dot plot is expected to shift higher, with policymakers predicting less rate cuts this year than before.

The Fed's decision is due on Wednesday during U.S. trading hours, preceded by May U.S. consumer inflation numbers.

"You have two big things tomorrow from the dollar's near-term direction point of view," a currency trader at a bank said.

The rupee "till then should basically see narrow intraday moves with 83.50 acting a centre point", he said.

The rupee is not far away from the 83.5750 all-time low hit in April. The Reserve Bank of India has been regularly selling dollars at near 83.50 to defend the local currency, according to traders.

Ahead of the May U.S. inflation data, the New York 1-year surveyed consumer inflation expectations fell to 3.17% in May from 3.26% in April.

This will be "some relief" considering other inflation expectations measures have been showing signs of increase recently, ING Bank said in a note.

KEY INDICATORS:** One-month non-deliverable rupee forward at 83.56; onshore one-month forward premium at 6.25 paise

** Dollar index at 105.14** Brent crude futures down 0.3% at $81.4 per barrel** Ten-year U.S. note yield at 4.45%

** As per NSDL data, foreign investors bought a net $642mln worth of Indian shares on Jun 7

** NSDL data shows foreign investors bought a net $154.7mln worth of Indian bonds on Jun 7