Research Report on GST 2.0 by Madhavi Arora - Chief Economist, Emkay Global Financial Services Ltd

The GST overhaul, effective 22-Sep, is a significant shift aimed at stimulating growth through consumption-led strategies, especially as indirect taxes are regressive in nature. The loss to the exchequer is estimated at ~0.14% of GDP, with states possibly taking a larger hit. However, with compensation cess ceasing to exist (nearly 0.5% of GDP), there is a de-facto demand boost for the economy (consumption sector), even as that revenue was not allowed to be used for fiscal math/budgetary flows. This move strengthens our longstanding sectoral rotation theme of ‘consumption over capex’. Ceteris paribus, such tax changes would add ~0.6% of GDP to domestic demand on an annualized basis and should boost (mass) consumption in FMCG, consumer durables, autos, and similar sectors.

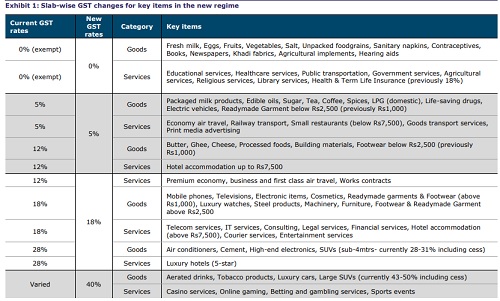

GST overhaul comes into effect

The GST rationalization from 22-Sep will lead to a shift toward a dual-slab structure, ie: 5% and 18%, replacing the current 4-tier structure, along with a 40% slab for luxury and sin goods (mostly intoxicants). Compensation cess for most goods will cease to exist by 22-Sep and fully by end-CY25. Segments like i) entry-level PVs (and even large SUVs), ii) most 2Ws, ii) a majority of consumer durables and consumer staples will see substantial benefits. Insurance and cement sector gains, however, will be constrained.

Limited estimated hit to the exchequer

The government estimates GST changes-led net revenue loss of Rs480bn (0.14% of GDP), with gross revenue loss at Rs930bn, while the new category of sin/luxury tax would provide additional revenue of Rs450bn. Static calculations have been made using FY24 consumption basket as the base. This would ease some of the fiscal slippage fear in the bond market. We note that there is currently pressure on the Centre’s gross tax revenue (GTR), already trailing budgeted growth (GTR growth for 4MFY26 is tracking ~0.8% vs 13% BE), making the BE tax buoyancy of 1.1x appear too ambitious.

However, some buffers may be available in the form of higher non-tax revenue, helped by higher RBI and PSU dividends as well as possible divestment in IDBI/PSBs’ stake sales (reducing the risk of divestment slippage). We will also keep an eye on i) the government’s spending pattern to bridge taxation gaps in FY26 by cutting other expenditure (miscellaneous capex), and ii) whether fiscal support to tariff-affected sectors is largely in the form of credit guarantees (does not impact fiscal math directly) or direct fiscal support (subsidies).

Domestic demand impact, ceteris paribus, could be ~0.6% of GDP The effective demand gain must be seen in light of simplifying the regressive indirect tax structure – India’s indirect tax-to-revenue ratio is one of the highest among EMs. Technically speaking, the loss to the exchequer should be seen as a net gain to private economic agents. However, there are a few factors to note:

1) The annualized consolidated fiscal hit with the GST rejig appears to be contained under Rs500bn (0.14% of GDP), adjusting for the new luxury + sin tax, per the government’s calculations. However, with compensation cess ceasing to exist (nearly 0.5% of GDP), there is a de-facto demand boost for the economy (consumption sector), even as that money was not allowed to be used for fiscal math/budgetary flows for either the Centre or states and was only to pay for redemption of/interest on Covid-related loans.

2) Notably, some items in the existing highest GST slab (28%) attract compensation cess, taking their effective rate to +45% (for instance, luxury cars effectively taxed earlier at 48-50% will now be subsumed within the lower GST tax of 40%).

3) The positive spill-over effect on consumption owing to reduction in indirect tax incidence, easier compliance, correction in the inverted duty structure in some key sectors, etc, would come into effect with a lag. The impact would be more concentrated in mass consumption items, contingent on demand elasticities.

‘Consumption over capex’ sectoral rotation theme gathers further steam

Overall, this implies a lower fiscal drag in FY26/27 and potentially a de-facto demand boost of ~Rs2trn (0.6% of GDP) to the consumption economy in CY27, with compensation cess getting dissolved. This reinstates our sector rotation theme of consumption over capex. All else being equal, such tax changes should boost (mass) consumption in FMCG, consumer durables, autos, and similar sectors. Sectoral winners: Autos, FMCG, durables, cement, footwear/apparel, QSRs, hospitals/insurers; Sectoral losers/to watch: Upstream oil & gas, coal-linked power, and select ancillaries (maybe metals, if cess on coal is not removed)

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354