Reduce Greenlam Industries Ltd For Target Rs. 547 By Yes Securities Ltd

9MFY25 performances below expectations; downgrade to REDUCE!

Result Synopsis

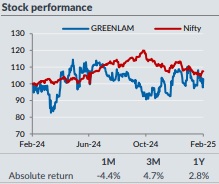

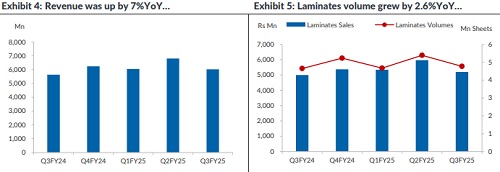

Greenlam Industries Ltd (GRLM) reported a benign revenue growth of 7%YoY while operating margins contracted 207bps YoY to 10.6%. Laminates sales (86% of revenue), increased marginally by 4%YoY to Rs5.20Bn, driven by 3% growth in volumes and 1% improvement in blended realization over similar period. In laminates, domestic volumes (54% of volumes) declined by 8%YoY & 2-year CAGR remained flattish. Export volumes (46% of volumes) increased by 21%YoY (2-year CAGR came in at 13%). On revenue front, domestic sales (49% of laminate revenue) degrew marginally by 3%YoY and export sales (51% of laminate revenue) increased by 12%YoY. Operating margins contracted to 13.2% as compared to 15.8%/14.7% in Q3FY24/Q2FY25 respectively. Veneer and allied segment’s revenue for the quarter stood at Rs519Mn (9% of overall revenue), a growth of 9%YoY and operating margins also improved to 2.7% Vs 0.6% in Q3FY24 and 0.9% in Q2FY25. For the quarter ply volumes stood at 1.16msqm Vs 1.02msqm in previous quarter, an improvement of 14%QoQ. ASP stood at Rs257/sqm as compared to Rs218/Rs250 in Q3FY24/Q2FY25 respectively. Revenue for this segment (5% of overall revenue), stood at Rs304Mn, a growth of 17%QoQ. EBITDA loss for the quarter came in at Rs62Mn Vs Rs83Mn/Rs67Mn in Q3FY24/Q2FY25 respectively.

Management Guidance

For FY25E, management aims to end the year with growth of 12-13% Vs previous target of 18-20%. In FY26E, company has guided for top-line growth of 18-20%. At peak with all new plants operating at full utilization, management aims to achieve turnover of Rs40Bn by FY28E.

Our view

Overall we expect 9% volume CAGR for laminate segment with operating margins of 15% over FY24-FY27E. While we do not foresee any major improvement in veneers and allied segments, new categories viz. Plywood and Particle board (Chipboard) will be the key monitorable going ahead. Though plywood has reported decent growth, the same has been below expectations. The ramp-up of Chipboard plant will drive topline for coming 2-years. However blended margins are likely to remain under pressure. We have lowered our EPS est for FY25E/FY26E/FY27E by 17%/9%/8% respectively to Rs8.7/14.4/18.2 and valued the company at P/E(x) of 30x on FY27E EPS arriving at a target price of Rs547. Hence, we have downgraded to stock to REDUCE from ADD.

Result Highlights

* Revenue for the quarter stood at Rs6Bn, a growth of 7%YoY & decline of 12%QoQ.

* EBITDA margins stood at 10.6% Vs 12.6%/12% in Q3FY24/Q2FY25 respectively. Absolute EBITDA declined by 11%YoY & 22%QoQ to Rs635Mn.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632