RBI MPC Research Report by Emkay Global Financial Services

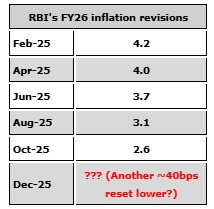

The MPC’s decision to hold rates unanimously today largely hinges on the members waiting for clouds to clear around external and domestic uncertainties, including the impact of tariff hikes, GST cuts, and transmission of past easing. However, emergence of dissent on policy stance, to shift to accommodative, by two external members hints at an emerging division within the MPC and, hence, some room for easing ahead. This view is reinforced by policymakers acknowledging a potential growth moderation in 2H as tariff effects kick in, and noting that the uncertain outlook has created “policy space to further support growth”. Interestingly, the RBI expectedly revised down the FY26 inflation forecast for the fourth time in a row, to 2.6% now from 3.1%, and we see risk of a further undershoot of ~30-40bps. This could further support the case for a December rate cut (and beyond, depending on how tariff effects evolve). Macro resets in the form of consistent inflation undershoots, down-trending core inflation, followed by weaker sequential 2H demand and sub-8% nominal GDP growth in FY26E call for front-loaded rather than back-loaded policy support. The timing and magnitude of rate cuts ahead will therefore be crucial.

Separately, today’s policy has aptly focused on improving and liberalizing the micro-market structure and competitiveness of the banking sector by reducing its transaction costs and deepening operational freedom– all of which will likely improve the banking credit flow, over time.

The MPC stands pat despite lowering inflation forecast again, albeit shows some dovish bent

In line with the consensus view, the RBI decided to keep the policy repo rate unchanged at 5.5%, with a unanimous vote. The stance has been kept neutral to maintain policy flexibility, while two external members dissented, favoring an accommodative stance over neutral. There was a recognition that overall inflation outlook has turned even more benign since the last MPC meeting, with a further 50bps downward revision to FY26 inflation. Despite sharply lowering its FY26 inflation forecast—the fourth time since April—the decision to leave rates unchanged emanated from factors like 1) current growth trends looking resilient, 2) year-ahead inflation staying above 4%, and most importantly, 3) policy preference to wait for clarity on external and domestic uncertainties, including tariff hikes, GST cuts, and the pass-through of past easing. That said, policymakers acknowledged the potential moderation in growth in 2H, as tariff effects kick in, noting that the uncertain outlook has created “policy space to further support growth”.

Growth-inflation dynamics considered comfortable, though looming headwinds also acknowledged

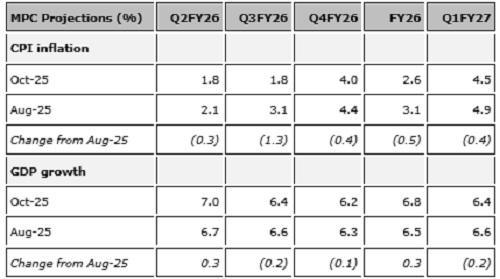

The MPC raised its FY26 growth forecast to 6.8% from 6.5% earlier (Emkay: 6.5%), with the improved outlook based on the impending impact of GST rationalization, along with a healthy monsoon and kharif sowing. However, headwinds from trade/tariff uncertainties and global risk-off sentiment were acknowledged, with these likely to adversely impact growth from H2 onward. GDP growth for FY27 was forecast to moderate to 6.6% (per the MPR), assuming a normal monsoon and no external/policy shocks. On the inflation front, the FY26 forecast was lowered further to 2.6% (3.1% earlier; Emkay: 2.2%), largely owing to GST rationalization, along with the benign trajectory for food prices. While an adverse base effect will cause headline CPI to rise to >4% from 4Q, the forecast for 1QFY27 was also lowered, to 4.5% from 4.9% earlier, while FY27 CPI was forecast at 4.5%, assuming a normal monsoon and no external/policy shocks.

The rate easing cycle may still have further room to run; December policy stays live

We understand that the RBI’s decision to keep rates steady is hinging on clarity around external and domestic uncertainties, including tariff hikes, GST cuts, and transmission of past easing, while their continued focus on the 1-year-ahead expected inflation (that is looking well above 4%) may have also weighed in. We see risks of a further undershoot of ~30-40bps in RBI’s FY26/FY27 inflation forecast, which could support the case for a December rate cut (and beyond, depending on how tariff effects evolve). Given the repeated undershoots versus forecasts, we believe the focus on one-year-ahead expected inflation looks increasingly misplaced in a fast-changing environment, particularly as Asia’s macro backdrop shifts toward a disinflationary bias. Domestically, core inflation (ex-gold/silver) continues to ease, reflecting softer demand. FY26 nominal GDP is likely to print below 8%, necessitating a recalibration of key macro and market variables—fiscal deficit/GDP, debt/GDP, credit growth, corporate earnings, and FPI flows, among others. A shortfall in nominal growth would mean that a much sharper fiscal compression is needed for achieving similar debt/GDP improvements. This macro reset calls for front-loaded rather than back-loaded policy support. The timing and magnitude of rate cuts ahead will therefore be crucial.

Significant changes proposed in liberalizing banks’ operations and improving transaction costs

The main takeaway of today’s MPC meeting was the policy focus on improving the micro-market structure and competitiveness of the banking sector. The proposed policies will not only reduce banks’ transaction costs, but also liberalize and deepen their operational freedom. Proposals like i) M&A lending, (ii) easing Large Exposures Framework (LEF) guidelines, iii) risk-based deposit risk premiums, iv) reduced risk weights on infra lending by NBFCs, v) flexibility for banks to decide subsidiary businesses, etc are welcome moves for banking system efficiency. The second-round effect of the same is likely to be felt in the banking credit flow over time (see detailed section on Developmental and Regulatory policies below)

RBI MPC Macro Projections: Oct-25 vs Aug-25

Developmental and Regulatory Policies

Several announcements were made on the developmental and regulatory front, with a view to improving the competitiveness of the banking sector, improving credit flow, promoting ease of business, and simplifying FX management, among others. The most notable measures are:

* Proposal to reduce risk weights on MSME and residential real estate (including Housing loans) – will be positive for large banks and those with relatively low capital buffers

* Risk-based deposit insurance premium introduced (currently uniform) – will incentivize sound risk management by banks and reduce premium to be paid by better-rated banks, especially large banks

* Final guidelines on forms of business and prudential regulation for investment shall be issued shortly, where restrictions on business overlap between banks and their subsidiaries are being removed. This should be positive for large banks

* Framework proposed to allow Indian banks to lend to corporates for acquisition financing

Regulatory ceiling on lending against listed debt securities removed; lending limit against shares raised from Rs2mn to Rs10mn per borrower; IPO financing limit increased from Rs1mn to Rs2.5mn per borrower

* Proposed to withdraw the 2016 framework that disincentivized lending by banks to specified borrowers (with system-wide credit limits of Rs100bn and above). Any concentration risk shall be addressed by the regulator through specific macro-prudential tools, as and when considered necessary

* Reference FX rates to be published for major trading partners to facilitate rupee-based transactions and reduce the need for FX crosses

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

.jpg)