RBI Monetary Policy Preview: 25-bps Rate Cut Likely as RBI Balances Growth Revival & External Risks by Prabhudas Lilladhar

The RBI’s February 2025 Monetary Policy Committee (MPC) meeting is shaping up to be one of its most finely balanced decisions in recent years. The central bank is caught between tight liquidity, slowdown in consumption demand, and rising external vulnerabilities, forcing it to initiate an easing cycle while keeping inflation under control.

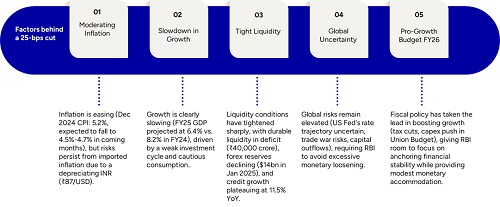

A 25-bps rate cut is the most probable outcome, reducing the repo rate from 6.50% to 6.25%, given the following factors:

* Inflation is easing (Dec 2024 CPI: 5.2%, expected to fall to 4.5%-4.7% in coming months), but risks persist from imported inflation due to a depreciating INR (Rs 87/USD).

* Growth is clearly slowing (FY25 GDP projected at 6.4% vs. 8.2% in FY24), driven by a weak investment cycle and cautious consumption.

* Liquidity conditions have tightened sharply, with durable liquidity in deficit (Rs 40,000 crore), forex reserves declining ($14bn in Jan 2025), and credit growth plateauing at 11.5% YoY.

* Global risks remain elevated (US Fed’s rate trajectory uncertain, trade war risks rising, capital outflows increasing), requiring RBI to avoid excessive monetary loosening that could accelerate rupee depreciation.

* Fiscal policy has taken the lead in boosting growth (tax cuts, capex push in Union Budget), giving RBI room to focus on anchoring financial stability while providing modest monetary accommodation.

The RBI is likely to maintain a measured, data-dependent approach rather than committing to an aggressive easing cycle upfront. The April 2025 policy meeting will be crucial in determining the pace of further cuts based on inflation durability, INR stability, and global liquidity conditions.

Key Insights:

First 25 bps Cut to 6.25% Likely, Signaling the Start of a Gradual Easing Cycle: RBI is expected to lower the repo rate from 6.50% to 6.25%, marking the first cut since February 2023. The decision will be guided by slowing GDP growth, easing inflation, and tighter liquidity conditions, while maintaining caution on rupee stability and external risks. Further cuts of 50-75 bps in CY25 will depend on inflation sustainability and global monetary conditions.

Economic Growth Weakening, Requires Monetary Support: India's GDP growth is projected at 6.4% in FY25, down from 8.2% in FY24, reflecting weak private investment and sluggish global demand. Q2 FY25 growth slowed to 5.4%, and while Q3 and Q4 are expected to improve, the underlying momentum remains weak.

Inflation Cooling But Imported Price Risks Persist: Headline CPI inflation eased to 5.2% in Dec 2024 and is expected to drop further to 4.5%-4.7% in Q4 FY25, driven by a sharp correction in vegetable prices and stable cereal prices. Core inflation remains subdued. However, risks remain from a depreciating rupee (Rs 87/USD), and potential supply shocks due to rising risks of a trade war, could limit RBI’s pace of rate cuts beyond 50 bps in CY25.

Why Not a Cut Beyond 25-bps?

Liquidity Conditions Tightening, Forcing RBI’s Hand: Durable liquidity turned negative for the first time in years, at a deficit of Rs 40,000 crore as of mid-Jan 2025. RBI has already infused Rs 1.5 trillion via OMO and repo operations, but liquidity stress persists, warranting a rate cut and possibly a 50 bps CRR cut in upcoming meetings.

Rupee Under Pressure, Limiting Scope for Aggressive Rate Cuts: INR has depreciated to Rs 87/USD, down from Rs 84.7/USD in Dec 2024, driven by stronger USD, rising US 10Y yields (4.51%), and $7.5bn FPI outflows since Nov 2024. The narrowing India-US rate differential is increasing capital outflow risks, forcing RBI to calibrate its easing cycle cautiously to avoid excessive rupee weakness. Any disorderly INR depreciation would raise imported inflation risks and require forex reserve depletion to stabilize markets.

Global Risks Increasing, Requiring RBI to Maintain a Measured Stance: The US Federal Reserve’s policy trajectory remains uncertain, with rate cut expectations moderating amid strong labour market data. US-China trade tensions and new tariffs imposed by the US on Feb 1 (10% on China) add volatility to global trade and financial markets. RBI will have to balance domestic monetary easing with the need to prevent capital outflows, manage currency stability, and respond to external shocks.

Fiscal Policy Shift Eases Some Pressure on RBI to Cut Aggressively: The Union Budget 2025-26 has provided consumption support through tax cuts and capex incentives, partially reducing RBI’s burden in stimulating growth. Fiscal expansion gives RBI room to focus more on liquidity management and financial stability, rather than frontloading aggressive rate cuts. This reinforces a staggered approach to monetary easing.

Policy Outlook - Gradual and Data-Driven Easing with 50-bps Cuts in 2025

RBI’s February policy is expected to initiate a measured easing cycle, starting with a 25-bps cut now, followed by another 25-50 bps later in CY25, contingent on inflation durability and INR stability. Liquidity measures, including OMO and potential CRR adjustments, will remain the primary tools to address financial market stress, while rate cuts will be paced to avoid external vulnerabilities and capital outflows.

Exhibit 1: Key Factors behind a likely 25-bps cut in Feb-25 MPC meeting

Above views are of the author and not of the website kindly read disclaimer

.jpg)