2024-02-08 11:31:53 am | Source: PR Agency

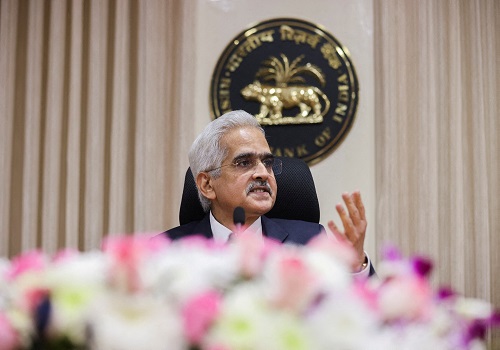

Quote on the RBI monetary policy announcement and its impact on real estate and home loan borrowers by Kaushik Mehta, RUloans Distribution

Below the quote on the RBI monetary policy announcement and its impact on real estate and home loan borrowers by Kaushik Mehta, Founder & CEO of RUloans Distribution

"After the latest RBI MPC meeting, the RBI maintained the repo rate at 6.5%. This decision reflects the RBI's cautious yet optimistic stance, aligning with a stable interest rate environment and fostering borrower confidence for informed financial decisions. Borrowers, particularly in home and personal loans, may explore options to optimize their financial commitments, such as transferring loans to banks offering lower rates or opting for part payments to reduce EMIs. Additionally, the government's focus on real estate is poised to provide a significant boost to the housing loans segment, with policies and incentives aimed at stimulating activity and enhancing accessibility to housing finance, benefiting both borrowers and lenders. Furthermore, recent fiscal measures outlined in Budget 2024-25 aim to further support affordability and accessibility to loans, particularly benefiting middle-class individuals and stimulating economic growth within the housing sector."

Above views are of the author and not of the website kindly read disclaimer

Disclaimer:

The content of this article is for informational purposes only and should not be considered financial or investment advice. Investments in financial markets are subject to market risks, and past performance is not indicative of future results. Readers are strongly advised to consult a licensed financial expert or advisor for tailored advice before making any investment decisions. The data and information presented in this article may not be accurate, comprehensive, or up-to-date. Readers should not rely solely on the content of this article for any current or future financial references.

To Read Complete Disclaimer Click Here

Latest News

Pre budget Quote on IT Industry by Pradyumn Sharma, ...

Pre budget Quote on Technology & IoT sector by Jani ...

Department of Commerce introduces Diamond Imprest Au...

Daily Commodity Market Outlook 22.01.2025 by Mr. An...

TCS soars on the bourses

Hiring in India up by 31 pc in Dec, AI job market bo...

Stock Picks : Reliance Industries Ltd and DLF Ltd By...

India witnesses 8 pc jump in average flat size in 20...

Stock of the day : Aditya Birla Fashion and Retail L...

Pre-Budget Quote on OTT and Entertainment Sector by ...