2025-02-08 02:08:24 pm | Source: LKP securities Ltd

Quote on Rupee by Jateen Trivedi, VP Research Analyst - Commodity and Currency, LKP Securities

Below the Quote on Rupee by Jateen Trivedi, VP Research Analyst - Commodity and Currency, LKP Securities

"Rupee traded above 87.42 after the RBI cut rates by 0.25% to 6.25%, maintaining a neutral stance while acknowledging declining inflation and slower growth, creating room for policy support. The RBI revised FY25 GDP growth down to 6.4% (from 6.6%) and projected 6.7% for FY26, citing an investment-led recovery.

CPI inflation expectations were lowered to 4.8% for FY25 and 4.2% for FY26, supported by easing food prices and a favorable crop outlook. However, the RBI remains cautious on global risks, including trade tensions and financial volatility.

Despite the minor rupee bounce, further stability depends on FII flows and global market sentiment. The rupee range is expected to stay between 87.25-87.60."

CPI inflation expectations were lowered to 4.8% for FY25 and 4.2% for FY26, supported by easing food prices and a favorable crop outlook. However, the RBI remains cautious on global risks, including trade tensions and financial volatility.

Despite the minor rupee bounce, further stability depends on FII flows and global market sentiment. The rupee range is expected to stay between 87.25-87.60."

Above views are of the author and not of the website kindly read disclaimer

Disclaimer:

The content of this article is for informational purposes only and should not be considered financial or

investment advice. Investments in financial markets are subject to market risks, and past performance is

not indicative of future results. Readers are strongly advised to consult a licensed financial expert or

advisor for tailored advice before making any investment decisions. The data and information presented

in this article may not be accurate, comprehensive, or up-to-date. Readers should not rely solely on the

content of this article for any current or future financial references.

To Read Complete Disclaimer Click Here

Latest News

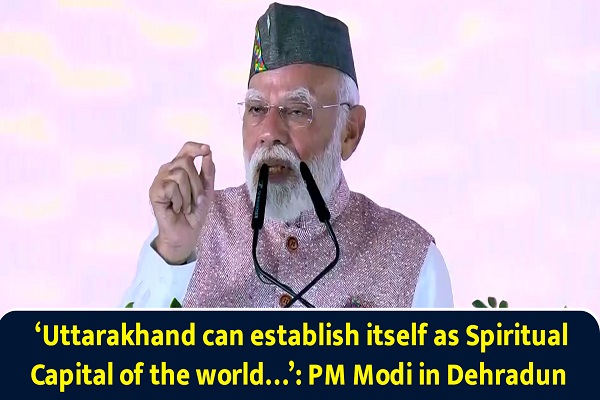

Uttarakhand: PM NarendraModi holds mega roadshow in ...

Caring for Your Heart, Caring for Your Life

Haryana DGP OP Singh`s light moment with journo evok...

Work-Life Balance: The Key to a Healthy and Producti...

`Uttarakhand can establish itself as Spiritual Capit...

Wild Leg Fashion: The Bold Trend Making a Statement

ICC Women`s World Cup star Renuka Thakur visits home...

South Korea reaches consensus on 2035 greenhouse gas...

MOSt Advisor November 2025 by Siddhartha Khemka, Sr....

Innovation, Research, and Collaboration Drive India`...

Tag News

MOSt Advisor November 2025 by Siddhartha Khemka, Sr. Group Vice President, Head - Retail Res...

Quote on Gold 07th November 2025 from Jateen Trivedi VP Research Analyst - Commodity and Currency, LKP Securities

Quote on Rupee 07th November 2025 by Jateen Trivedi, VP Research Analyst - Commodity and Currency, LKP Securities

Quote on Market 07th November 2025 by Vinod Nair, Head of Research, Geojit Investments Limited

More News

News Not Found