Quote on RBI MPC announcement by Ms. Madhavi Arora, Chief Economist , Emkay Global Financial Services

Below the Quote on RBI MPC announcement by Ms. Madhavi Arora, Chief Economist , Emkay Global Financial Services

RBI MPC: Cut + Liquidity Support, Keeps Guidance Flexible

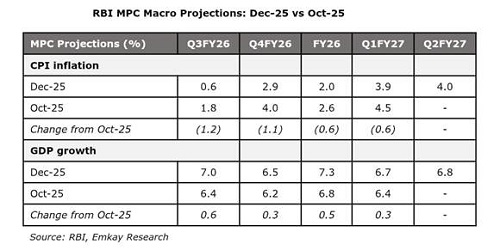

* With inflation persistently undershooting, the RBI expectedly found it harder to ignore its core mandate of inflation management and therefore finally delivered a unanimous 25bp cut to 5.25%.

* Clear near-term inflation visibility—and the need to shift away from an increasingly misplaced 1-year-ahead CPI anchor—has helped RBI with a December cut, after marking a fifth revision to FY26 CPI inflation.

* RBI’s inflation forecast is now in line with ours (RBI: 2.0%, Emkay: 1.92%), even as the governor reckoned the so-called “Goldilocks” narrative as he upgraded growth to 7.3% (Emkay: 7.3%).

* Tactically smart and flexible forward guidance has also complemented today’s rate easing, signalling openness to further easing—both on rates and liquidity (a departure from the June policy). Importantly, while acknowledging repeated headline undershoots, the governor also conceded that underlying price pressures are even more subdued.

* The announced primary liquidity infusion of ~Rs1.45tn (Rs1tn of OMOs and a $5bn buy–sell swap) is constructive, albeit modestly below our expectation of Rs2tn for the rest of FY26.

* Even so, this injection should meaningfully aid transmission, particularly as unsterilized FX intervention is likely to continue, making the liquidity support especially timely and effective at this stage of the cycle.

* We reiterate INR’s softness should not be read as rate-easing deterrent ahead, but a natural growth stabiliser.

Above views are of the author and not of the website kindly read disclaimer