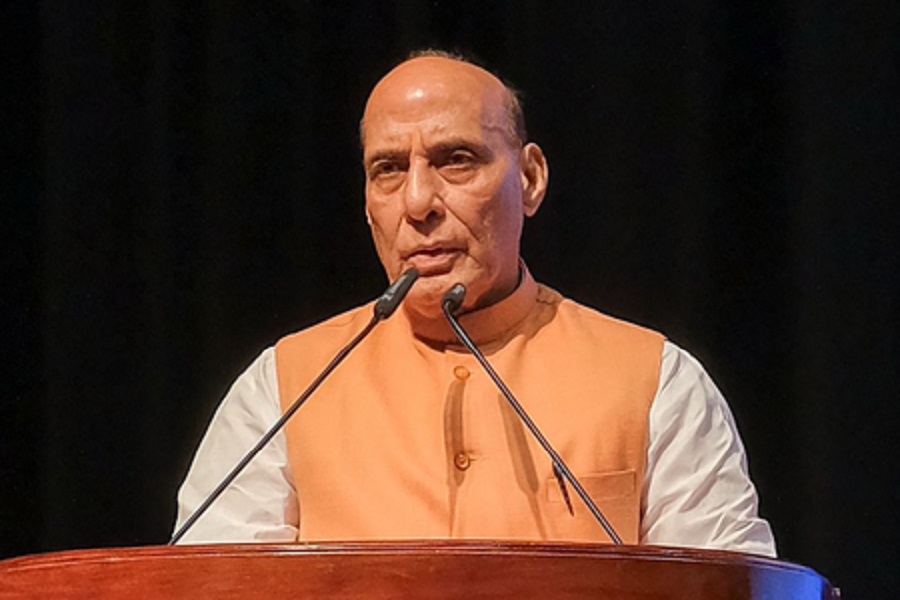

Quote on Market by Krishna Appala, Sr. Research Analyst, Capitalmind Research

Below The Quote on Market by Krishna Appala, Sr. Research Analyst, Capitalmind Research

Indian markets hit an all-time high as they cheered the Fed’s rate cut. The Nifty rose 1.2% this week, with Bank Nifty being the best performer, up 2.5% and also reaching an all-time high.

The 50 basis points rate cut was a positive surprise for global markets. A weaker dollar will support U.S. exports and bolster the global economy. The key takeaway from the Fed's commentary is the expectation of another 50 bps rate cut in 2024, with further cuts likely in 2025 and 2026, which is encouraging for the global economy.

In India, the RBI’s inflation target is set at 4%, and with the CPI Index for August 2024 at 3.6%, this indicates a possibility of a rate cut in the near future. The real impact will be felt when the RBI actually begins cutting rates, as we can expect to see an improvement in credit growth.

Initially, the reaction followed a typical 'buy the rumour, sell the news’ pattern, but within a day, the market resumed its upward trend, hitting an all-time high. This is positive for the long term, particularly for sectors like Financials, Pharma, and IT, where we expect demand to pick up

Above views are of the author and not of the website kindly read disclaimer