Prime Securities Limited Results October 2025

UNAUDITED FINANCIAL RESULTS (CONSOLIDATED) HALF YEAR ENDED SEPTEMBER 30, 2025

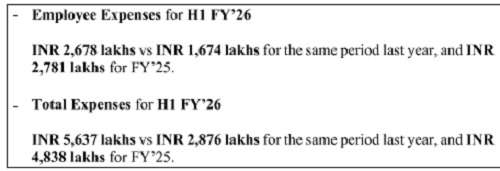

* The first half of FY'26 was marked by a substantial increase in personnel, both in the Investment Banking and Wealth Management verticals (across Prime Securities, Prime Research and Advisory and Prime Trigen Wealth).

* Total head count in the Group stands at 120 (September 30, 2025) vs about 35 (September 30, 2024).

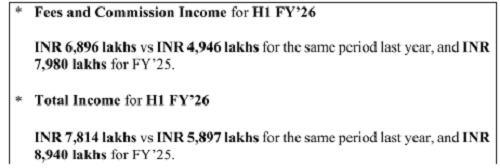

* A substantial thrust in Revenues and creation of new lines of business has resulted in:

* Reported Profit after Tax for H1 FY'26

INR 2,425 lakhs v/s INR 2,930 lakhs for the same period last year, and INR 3,830 lakhs for FY 25.

* Prime Trigen Wealth:

* Has onboarded 400+ clients and 300+ families in the first six months of its operations, leading to a sharp growth in AUM.

* Operates from 8 locations with over 80 employees.

* The company continues to successfully build a combination of annuity income flows and transactional (success based) revenue streams.

While investors should note that the advisory business does not lend itself to quarterly or annual comparisons, much less extrapolation, it is equally important to highlight that both the number and size of deals, have been steadily rising. The management remains optimistic on the prospects of the Company over the next few years.

* Prime's growth strategy involves the creation of annuity revenue flows through franchise businesses like Prime Trigen Wealth, to smoothen out the lumpiness of the episodic nature of the Investment Banking business.

Above views are of the author and not of the website kindly read disclaimer