Pharma & Healthcare Q1FY26 Result Preview by Axis Securities Ltd

PHARMA & HEALTHCARE Q1FY26 PREVIEW: NICHE LAUNCHES & HOSPITAL EXPANSION

We anticipate that pharmaceutical companies within our coverage will collectively demonstrate revenue growth of 9.9% YoY and 0.8% QoQ, along with EBITDA growth of 11.3% YoY and 3.6% QoQ. Moreover, adjusted PAT is expected to grow by 13.3% YoY and decrease by 3.5% QoQ. Domestic formulations and niche launches in the US market will likely drive this growth

Within the US generics, growth is particularly driven by products such as gRevlimid, gMirabegron, gSpiriva, gAlbuterol, gPrezista, gLenalidomide, gProlensa, gRivaroxaban, gtolvapatan and various biosimilars. The US market is anticipated to witness low single-digit growth, led by volume expansion in existing products, offset by continued price erosion. The legal dispute over gMirabegron is expected to persist in the US, involving Lupin and Zydus. Meanwhile, the Indian business is likely to see muted sequential growth, driven by sluggish performance in chronic therapies and a recovery in acute therapies. We estimate Dr. Reddy's, Cipla, and Aurobindo to report gRevlimid sales of $135 Mn, $35 Mn, and $29 Mn, respectively, in Q4FY25E.

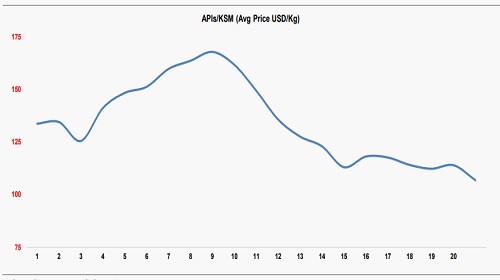

Additionally, we anticipate a 30bps improvement in margins on a YoY basis for most companies in our coverage. The primary reasons for this margin improvement are (i) New launches during the year's formulations business, (ii) Stable freight costs and decline in API prices, and (iii) Lower input costs and a better product mix towards niche launches

The price index of API/KSM, which covers the top 15 APIs imported from China and widely used as raw materials by pharma companies, shows that aggregate API prices remain negative QoQ. For the past three quarters, API prices have recorded a negative variance, indicating they have not yet bottomed out. This stabilisation trend could support improved gross margins for API companies in the upcoming quarters. The recovery in API prices may be driven by volume growth and a more stable supply chain. Additionally, in Q1FY26, crude prices declined and shipping rates remained stable, which could help maintain flat margins for pharma companies in the near term.

In Q1FY26, aggregate EBITDA margins of our under-coverage pharma companies are expected to improve by 30bps YoY.

Healthcare: Within our coverage, we anticipate the healthcare sector to register revenue growth of 19.8% YoY and 5.8% QoQ. This would be largely driven by an expected improvement in occupancies of up to 100 bps and ARPOB growth of 7–8%.

Our analysis indicates that Fortis, Max, and KIMS could achieve growth of 16.2%/26%/28.6% YoY, respectively, due to the installation of additional beds and the addition of new hospitals to their portfolios. However, Medanta may not lag behind its peers, although its Lucknow hospital has begun to show signs of a gradual recovery. Despite a soft quarter in healthcare, HCG could report healthy topline growth driven by contributions from the Vizag hospital. Additionally, we project an adjusted EBITDA growth of 28% YoY and 4% QoQ for our hospital coverage.

These companies may surpass industry growth, driven by a superior product portfolio and a strong product pipeline. In hospitals, Fortis, Max, and KIMS are expected to achieve higher occupancies and realisations as they continue to consistently gain market share and expand their margins.

Dr Reddy’s: We expect $235 Mn base business and $135 Mn gRevlimid sales in the US, with flattish growth in US sales QoQ. We have factored in stable gRevlimid sales QoQ. Commentary on the US base business and margin trend remains a key monitorable. The India and Europe businesses grew by 9%, while the Emerging Markets are expected to report 10% growth. Commentary on the US base business and margin trend is key monitorab

Cipla Ltd (CIPLA): CIPLA may face challenges in maintaining a stable market share in Albuterol and Advair. The company is gradually building market share in Lanreotide injections. We anticipate that Albuterol, Lanreotide, gRevlimid, and Brovana will contribute to stable sales of $221 Mn in the US market. Additionally, we expect $35 Mn in sales for gRevlimid in the last quarter. The Indian business is expected to report 8% YoY growth, while South Africa is projected to report 15% YoY growth. We expect overall EBITDA to remain flat at 3.2% YoY, with EBITDA margin declining by 90 bps YoY to 24.7% in Q1FY26.

Lupin: We anticipate 11.9% YoY revenue growth in Q1FY26, driven by a recovery in the domestic business and new launches in the US market. We also expect $270 Mn in US-based sales for Lupin, supported by contributions from gSpiriva, gSupreb, and gPrezista, along with greater pricing stability. Additionally, the niche launch of gMirabegron is expected to generate around $60 Mn in full-year sales, and Tolvaptan (180-day exclusivity) will contribute an additional $18 Mn this quarter. However, we expect some offsetting impact due to pricing pressure in Albuterol. EBITDA margins could improve by 190 bps YoY due to lower raw material prices and the launch of niche products in the portfolio. Lupin is expected to report a 16% YoY PAT growth in Q1FY26E.

We recommend BUY on Lupin, Aurobindo, Fortis, KIMS, and Max Health.

API/KSM (Raw Material): The price index of API/KSM, encompassing the top 15 APIs imported from China and predominantly used as raw materials by pharma companies, indicates that aggregate API prices remain negative QoQ. For the past few quarters, API prices have shown a consistent negative variance, suggesting they have not yet bottomed out. This stabilisation trend could lead to improved gross margins for API companies in the upcoming quarters. The improvement in API prices could be driven by volume growth and supply checks from China. Furthermore, in Q1FY26, crude prices were down, while shipping rates remained stable, potentially pointing to flat margins for pharma companies in the near term. However, in Q1FY26, our under-coverage pharma companies’ aggregate EBITDA margins are expected to improve by 30 bps YoY.

API/KSM: The price index of API/KSM, which comprises the top 15 APIs imported from China (majorly used as raw material by Pharma companies), indicates an aggregate API price decrease of 6% QoQ and ~9% YoY.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633