PGIM India Asset Management Pvt Ltd launches Multi Asset Allocation Fund

PGIM India Asset Management Pvt Ltd announced the launch of the PGIM India Multi Asset Allocation Fund (MAAF), an open-ended scheme designed to deliver long-term capital appreciation through strategic diversification across multiple asset classes.

The new fund offer opens for subscription on November 11, 2025 and closes on November 25, 2025. The scheme re-opens for subscription on December 03, 2025.

The fund offers investors exposure to multiple asset classes like equity, debt, Gold ETFs, Silver ETFs, Real Estate Investment Trusts (REITs), Infrastructure Investment Trusts (InvITs), with dynamic allocation tailored to market cycles.

“The PGIM India Multi Asset Allocation Fund is built to help investors navigate uncertainty while capturing opportunities across asset classes,” said Abhishek Tiwari, Chief Executive Officer, PGIM India Asset Management Pvt Ltd. “The popular saying "diversification is the only free lunch in investing" seems to have been made keeping Multi Asset Allocation Funds in mind where an investor can aim to improve his investing outcome without compromising return potential.”

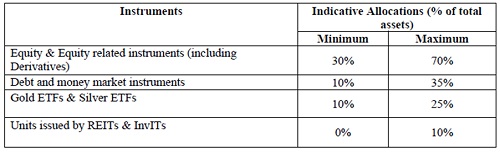

Asset Allocation

“In a world of uncertainty, multi-asset allocation funds offer clarity, diversification and resilience. In volatile markets, diversification isn’t just a strategy it’s a necessity. PGIM Multi Asset Allocation Fund endeavours to deliver that,” says Vinay Paharia, CIO, PGIM India Asset Management Pvt Ltd.

“PGIM Multi Asset Allocation Fund aims to deliver risk-adjusted outcomes across market cycles. By blending equity, debt, and commodities, we aim to deliver growth over long run while managing the downside risk,” says Vivek Sharma, Senior Fund Manager – Equities, PGIM India Asset Management Pvt Ltd.

Why Multi Asset?

Many investors base their decisions on historical performance, frequently buying assets that have recently done well. This tendency causes them to sell underperforming investments and purchase potentially overvalued ones, which can lead to lower returns. Strong gains in any asset class often result in substantial net inflows, indicating that investors typically enter the market after a rally. On the other hand, poor performance usually prompts rapid sell-offs. This reactive behavior—buying when prices are high and selling when they are low—can hurt long-term portfolio growth. Instead of trying to time the market based on recent movements, investors benefit more from adhering to a consistent, long-term strategy that reduces emotional decision-making.

Benefits of Multi Asset Allocation Fund:

* Different asset classes perform differently in different economic scenarios.

* Equities are great for long-term wealth creation but offer little to no protection during a down cycle, while Debt may provide stable returns but fail to capture the upcycle.

* Precious metals may provide greater downside protection during downcycles.

* A diversified portfolio with a mix of major asset classes may help to achieve risk-adjusted return over the longer term.

* Tax-efficient structure with equity-oriented treatment if equity investments are => 65%.

* Behavioral edge through professional rebalancing and reduced emotional bias.

* Strategic allocation to precious metals, which have historically outperformed during equity downturns. (Source: MFI ICRA, FactSet). E.g.:- Global Financial Crisis (2008), Euro Zone Sovereign Debt Crisis (2010).

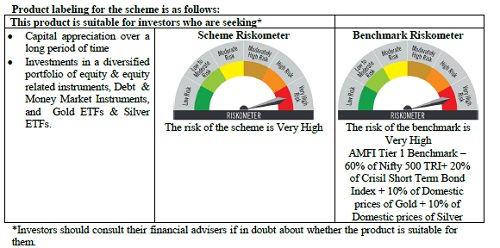

The fund will be managed by Vivek Sharma (Equity Portion), Anandha Padmanabhan Anjeneya (Equity Portion),Utsav Mehta (Equity Portion) and Puneet Pal (Debt Portion). The fund is benchmarked against 60% of Nifty 500 TRI + 20% of Crisil Short Term Bond Index + 10% of Domestic prices of Gold + 10% of Domestic prices of Silver.

Other key features:

* Plan/Options: IDCW (Payout of Income Distribution cum Capital Withdrawal option/ Reinvestment of Income Distribution cum Capital Withdrawal option) and Growth.

* Minimum Application: Initial Purchase/Switch-in - Minimum of Rs. 5,000/- and in multiples of Re. 1/-thereafter. Additional Purchase - Minimum of Rs. 1,000/- and in multiples of Re. 1/-thereafter.

* Exit Load: For Exits within 90 days from date of allotment of units : 0.50%. For Exits beyond 90 days from date of allotment of units : NIL

The above product labelling assigned during the New Fund Offer (NFO) is based on internal assessment of the scheme characteristics or model portfolio and the same may vary post NFO when actual investments are made.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Fund Folio : Equity AUM rises for the 12th successive year; net inflows moderate in CY25 by ...