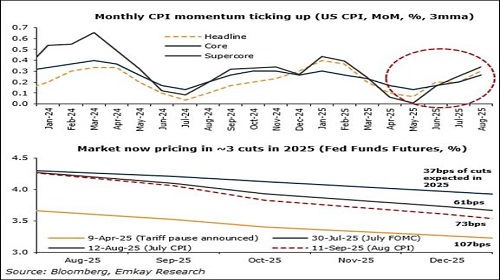

Perspective US CPI by Ms. Madhavi Arora, Chief Economist, Emkay Global Financial Services

Below the Perspective US CPI by Ms. Madhavi Arora, Chief Economist, Emkay Global Financial Services

US CPI: Some tariff pass-through visible, but Fed poised to cut next week

* Aug'25 CPI was largely in-line, removing a key risk for the markets ahead of next week's FOMC meeting. While this print shows that inflation is unlikely to get better soon, the sharp weakening in labor market dynamics means that a 25bps cut next week is now certain, with the market now pricing 3 cuts in total in 2025

* Headline CPI was higher than expected at 0.4% m/m (0.3% est) and was up 2.9% y/y (2.9% est). Core CPI was in-line at 0.3% m/m, with the YoY rate came in at 3.1% (vs 3.1% est)

* Core goods inflation rose to 0.3% m/m (vs 0.2% prior). The rise was led by apparel (0.5% m/m), used cars (1% m/m) and certain recreational commodities (0. 5-0.7%) - indicating that some tariff pass-through is now taking place

* Core services dipped to 0.3% m/m (vs 0.4% prior). The pace of shelter costs rose (0.4% m/m), with lodging away from home rising sharply (2.3% m/m)

Core services excluding shelter (‘supercore’) dipped to 0.3% m/m vs 0.4% prior. Airfares rose ~6% m/m (4% prior), driving most of the core services print

* The largely in-line print has led to a mild market rally: S&P futures are up 0.2%, while UST2Y/10Y are down 3bps/1bp resp, and DXY is down 0.1%

The mkt is now pricing in nearly three Fed rate cuts (73bps) in 2025, with this print raising bets of further Fed easing. The probability of a cut in September has remained at 91%

* August's CPI data confirms that while inflation may not be getting worse, it is not getting a lot better either - but with the labor market where it is (and tariffs not yet showing up decisively in the data), the Fed is now almost certain to turn towards the employment side of its dual mandate and restart its easing cycle next week

Above views are of the author and not of the website kindly read disclaimer

More News

Quote on?Cabinet approves UPI incentive of Rs.1,500 crore to banks by Mr. Dilip Modi, Founde...