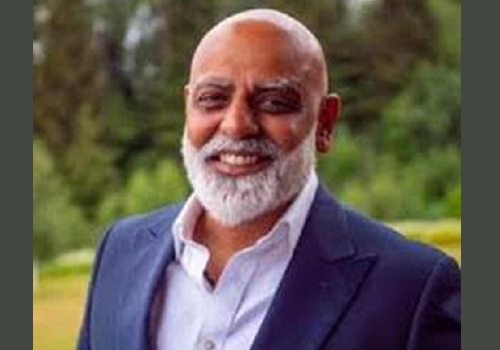

Perspective on MPC Data by Mr Nish Bhatt, Founder & CEO, Millwood Kane International

Below the Perspective on MPC Data by Mr Nish Bhatt, Founder & CEO, Millwood Kane International

‘The MPC keeping the repo rate and policy stance unchanged is on the expected lines. Reducing the CRR by 50 bps is a positive surprise. CRR cut will help infusion of over Rs 1.6 lakh crore into the system. It will help boost the credit offtake and the overall growth of the economy.

It is concerning the central bank has hiked its CPI inflation estimate and reduced its growth rate for FY25. This requires a coordinated effort on the monetary and fiscal front. The CRR cut is largely seen as a precursor to a rate cut in early 2025. The RBI has delivered on its part by indicating its stance on reducing rates in due course. The fiscal policy needs to provide the much-needed impetus to growth. Government spending is important to provide the fillip to growth.’

Above views are of the author and not of the website kindly read disclaimer