Paytm Introduces Total Balance Check for UPI-Linked Bank Accounts with Real-Time Balance Display

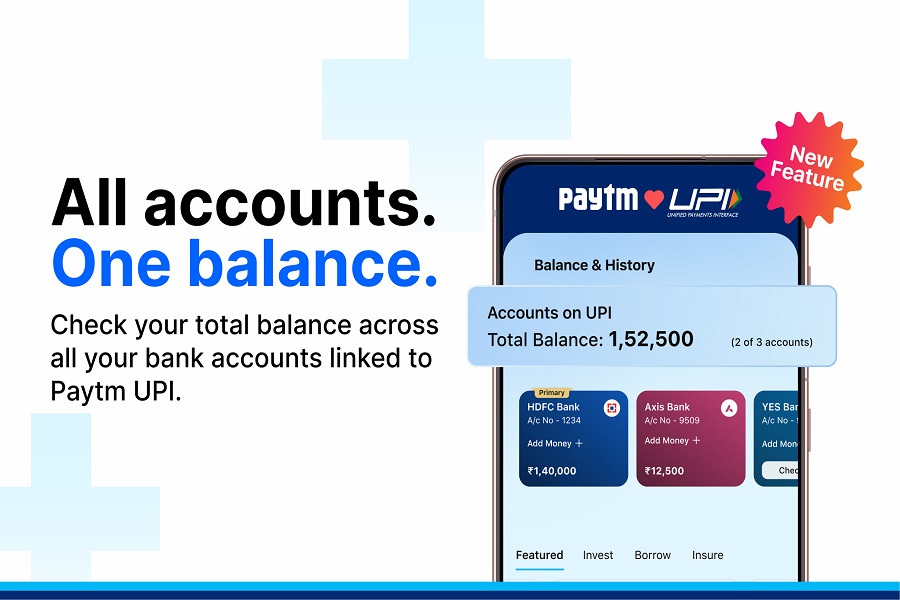

Paytm (One97 Communications Limited), India’s leading payments and financial services distribution company and pioneer of mobile payments, QR codes, and Soundbox, now enables users with multiple bank accounts linked for UPI on the Paytm app to view their total bank account balance in one place, without the need for manual addition or switching apps. It simplifies financial management by providing a consolidated view of funds and also displays individual bank account balances for a more detailed understanding of finances.

Earlier, account holders had to check the balance of each bank account separately and manually calculate the total. With this enhancement, Paytm securely fetches individual bank balances after UPI PIN verification and instantly displays the total balance upfront, making fund management simpler and faster. The service is available to users who have linked their bank accounts for UPI on the Paytm app, and is especially useful for those who maintain multiple accounts for savings, spending, or salary credit and often lose visibility into their overall finances.

Paytm Spokesperson said, “We believe in simplifying financial management through continuous innovation. With Total Balance View, users who have linked multiple bank accounts for UPI on the Paytm app can effortlessly check both total and individual bank balances. This makes it easier to track expenses, plan spends, manage savings, and make informed financial decisions.”

Here’s how to view total balance across all UPI-lined bank accounts on the Paytm app:

* Open the Paytm app and navigate to the “Balance & History” section

* Link your UPI-enabled bank accounts, if not already linked

* Once linked, check account balance of each linked account one by one by entering secured UPI PIN

* At the top of the screen, the app will dynamically sum up and display the total balance of all linked accounts every time balance is checked for any of the accounts

The company has introduced several innovations to make mobile payments more secure and efficient. These include the ability to hide or unhide specific payments for added privacy, home screen widgets like ‘Receive Money’ for quicker transactions, personalised UPI IDs that let users create unique and easy-to-remember handles while keeping mobile numbers private, and the option to download UPI statements in Excel or PDF formats. Taking mobile payments beyond India, Paytm now supports UPI transactions in countries such as the UAE, Singapore, France, Mauritius, Bhutan, Sri Lanka, and Nepal, making payments more seamless for Indian travellers abroad.

Above views are of the author and not of the website kindly read disclaimer