Paytm Introduces Personalized UPI IDs to Enhance Payment Privacy and Prevent Mobile Number Exposure

Paytm (One97 Communications Limited), India’s leading payments and financial services distribution company and the pioneer of mobile payments, QR codes, and Soundbox, has introduced personalized UPI IDs, enhancing privacy and offering a more flexible way to make mobile payments. This advancement reflects the company’s commitment to simplifying and securing everyday digital payments.

The new offering allows the selection of personalized UPI IDs such as name@ptyes or name@ptaxis, enabling individuals to send and receive money without revealing their mobile numbers. It is currently live on handles issued by Yes Bank and Axis Bank and will be extended to other banking partners shortly

Whether you're paying a shopkeeper, settling up with a delivery executive, or transferring money to a new vendor, Paytm remains India’s most trusted and secure way to pay. With personalized UPI IDs, Paytm now offers even greater privacy. When a user sends or receives money using their personalized UPI ID, their mobile number stays hidden from the transaction details. This protects personal information while still allowing individuals to create a unique and easily recognizable payment identity. It's a seamless experience, built for trust, security, and everyday convenience.

Paytm Spokesperson said, “We have introduced personalized UPI IDs to offer more choice and privacy in payments. We heard the feedback from our customers who wanted to keep their mobile numbers private and built this solution to address that need. We remain committed to developing thoughtful innovations that make payments safer and more convenient for all.”

To create a personalized UPI ID on the Paytm app:

* Open the Paytm app

* Tap on the profile icon and go to ‘UPI Settings’

* Select ‘Manage UPI ID’ and choose a personalized ID

* Confirm and activate the new UPI ID as the primary UPI ID to be used for payments

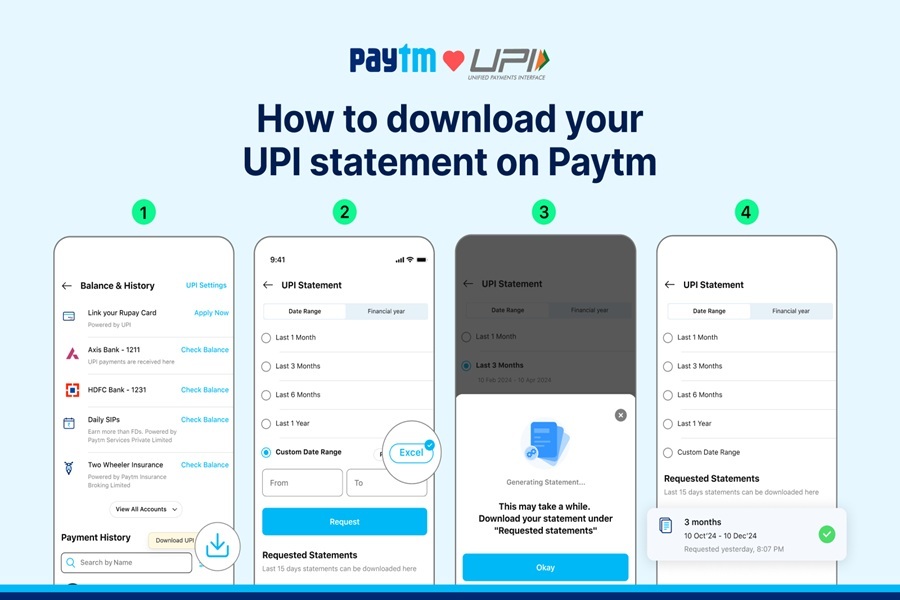

Paytm has introduced seven other key innovations to make mobile payments safer, smarter, and more trusted. These include: (1) the ability to hide or unhide payments for enhanced privacy, (2) Automatic categorization of spends & monthly spend summary to help track and manage expenses, (3) Receive Money widget for quick access to incoming payments on the mobile home screen (4) Scan and Pay widget on the mobile home screen for faster payments, (5) auto top-up for Paytm UPI Lite to ensure seamless low-value payments of upto Rs. 5000, (6) the option to download UPI statements in PDF and Excel formats for better financial tracking, and (7) a consolidated view of total balances across all UPI-linked bank accounts - without having to add up individual balances mentally. Internationally, Paytm now enables UPI payments in the UAE, Singapore, France, Mauritius, Bhutan, Sri Lanka, and Nepal, offering greater convenience to Indian travelers across the globe.

Above views are of the author and not of the website kindly read disclaimer