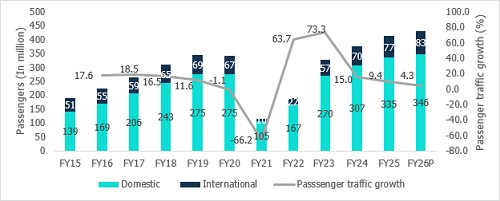

Passenger traffic growth at Indian Airports to slowdown to 4.3% in FY26, down from 9.4% in FY25: CareEdge Ratings

According to CareEdge Ratings, it anticipates passenger traffic to reach ~ 430 million passengers in FY26, revised from its earlier estimate of 445 million passengers. This translates to revised passenger traffic growth projections of 4.3% for FY26, from the earlier expected 8%, marking the lowest growth rate of the decade (excluding the COVID-19 period).

Palak Vyas, Associate Director, CareEdge Ratings said, “The downward revision reflects the impact of cross-border tensions in Q1 FY26, lower aircraft availability due to fleet-wide inspections following the fatal aircraft accident in June 2025, and delay in arrival of wide-bodied aircrafts. that dampened passenger traffic growth during the first half of the fiscal year. Over the medium term, with passenger traffic expected to grow at a CAGR of 8-9%, the outlook for the airport sector is favourable. However, timely delivery of wide-bodied aircraft shall remain monitorable for growth in international traffic.”

In H1FY26, total passenger traffic grew 2.6% YoY to 202 million passengers, compared with 197 million in H1FY25 (7.4 % YoY growth). Domestic traffic recorded muted growth of 1.6%, while international traffic continued to exhibit stronger momentum with 6.9% growth.

Air passenger traffic at Indian Airports

For the entire fiscal year, CareEdge Ratings forecasts domestic passenger traffic to increase by ~3.5%, while international traffic is expected to grow by ~8%. The latter half of FY26 is projected to see improved performance, driven by the festive season and the commencement of two new greenfield airports, which are expected to ease supply constraints and boost overall traffic growth.

Over the next 2-3 years, the airport sector's outlook is favourable, with CareEdge Ratings forecasting passenger traffic to grow at a CAGR of 8–9%. International traffic growth is expected to surpass domestic traffic growth, aligning with previous estimates. The outlook is supported by airport and airline capacity expansions, as well as robust air travel demand fuelled by favourable demographics and a rising middle-class population.

Maulesh Desai, Director, CareEdge Ratings said, “Despite lower passenger growth, the financial risk profile of airport players is expected to remain healthy with aggregate aero revenue for 11 assessed airports estimated to reach ~Rs.11,000-11,500 crore during FY26 registering a healthy y-o-y growth of ~50%. The net leverage is expected to improve below six times from FY27 onwards, as against earlier expectations of FY26 owing to lowering of passengers estimate. Regulatory mechanisms involving true-up of revenues in case of shortfall besides longer concession periods continue to impart financial flexibility to Indian Airports.”

The aero revenues for FY26 are supported by large tariff hike at one airport, first full year of implementation of tariff hike at three airports and commencement of one green field airport. However, aero revenue is expected to be slightly lower than earlier estimates. CareEdge Ratings notes that healthy operating income is expected to translate into an increase in profit before interest, taxes, depreciation, and amortization (PBILDT) with an aggregate y-o-y growth of above 40% for 11 airports.

Above views are of the author and not of the website kindly read disclaimer