Parliamentary panel pitches for raising investment rate to 35% of GDP to achieve 8% growth rate

In order to achieve the ambitious growth target of 8%, parliamentary panel has pitched for raising the investment rate from 31% of the Gross Domestic Product (GDP) to 35%. Besides, the Standing Committee on Finance has urged the government to maintain sustainable, growth-oriented energy policies that prioritise affordability and efficiency while balancing climate commitments with economic and social objectives. The committee also suggested that the Ministry/Central Electricity Authority (CEA) expedite the development of pumped storage projects (PSPs), recognising their critical role in strengthening energy security and reducing import dependency. Meanwhile, it noted that financing these investments may result in higher levels of current account deficit (CAD), which is challenging under current global circumstances.

The committee has emphasized the need for domestic-led growth, for which deregulation is crucial. It suggested a model of cooperative federalism -- facilitating dialogue with states on best practices in land, labour, capital, and regulatory reforms -- can streamline business processes and foster an investor-friendly environment. It said tailored fiscal reforms may be promoted in highly indebted states to improve their fiscal health while maintaining their capacity to invest in critical infrastructure and social development. Moreover, it has emphasized the need to unlock the untapped potential of India's agriculture sector for inclusive economic growth. It suggested a dual approach which focus on addressing immediate challenges while implementing long-term structural reforms. Further, for short-term stability, the committee has observed that the government's strategy such as maintaining buffer stocks; regulating market supplies; and subsidising key food items helps to stabilise food prices and ensure affordable access to essential commodities. It also noted that promoting diversified crop production, strengthening supply chain infrastructure, and encouraging private sector participation in agri-tech innovation are vital steps.

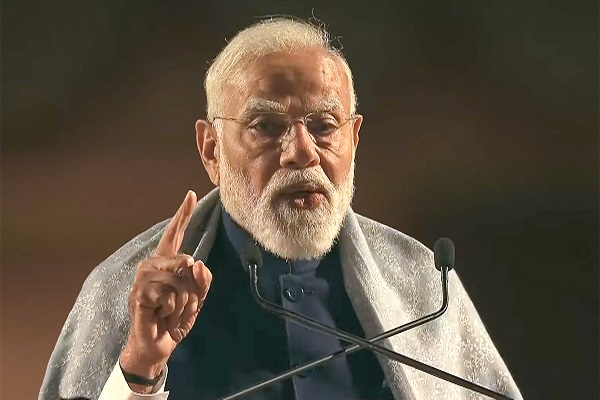

The committee highlighted that the current global trade environment, marked by protectionism and geopolitical volatility, presents a significant opportunity for India as this situation can be leveraged to pursue the guiding principle of 'Sabka Saath, Sabka Vikas, Sabka Vishwas, Sabka Prayas' and build an 'Atmanirbhar Bharat'. This path involves exploring new markets while simultaneously strengthening domestic manufacturing. Besides, the committee highlighted the need for sound government finances, with an emphasis on improving the quality of expenditure, particularly capital expenditure, and recognise the pivotal role of AI and data for effective governance. It also noted that despite positive corporate earnings, investment in people -- through higher wages, reskilling, and mental health support -- is essential for increased productivity. It concluded that India's economic roadmap must aim not only for a short-term $5 trillion economy but also for sustained, inclusive, and resilient long-term growth.