RBI Preview : Rate cuts to commence; to complement non-conventional easing by Emkay Global Financial Services

While a conventional 25bps rate cut in the upcoming MPC policy is less of a market debate, the actions around ‘what beyond a cut’ will be more watched. Easing by stealth via unconventional policy tools like liquidity and regulatory measures will continue. The RBI may also want to address the stress in the non-sovereign money market. We expect another round of ~Rs300bn OMOs, implying Rs900 bn+ in total in FY25E. A CRR cut is a close call, but a temporary cut may not address the underlying banking stress. Easing in ensuing tighter LCR norms (Apr-25 onwards) and lending standards might be a preferred policy tool. We will also watch for additional capital account easing actions via the FCNR route.

Policy tradeoffs turning less challenging – RBI’s rate cycle to commence with 25bps cut

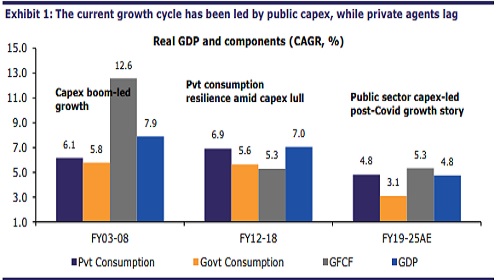

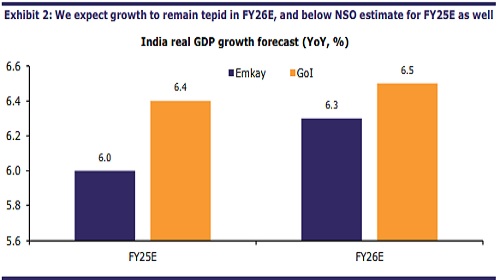

(1) Underlying growth tepid: We see downside risk to NSO’s advance GDP estimate of 6.4% for FY25 (RBI: 6.6%), and peg FY25E growth at 6% with only mild improvement in FY26E. To be fair, some sequential growth gains are visible in pockets, we are a far cry from a sustained and steady growth picture. But underlying growth remains tepid with missing private economic agents in the current cycle, and limited policy levers on net (including fiscal) to aid a turnaround.

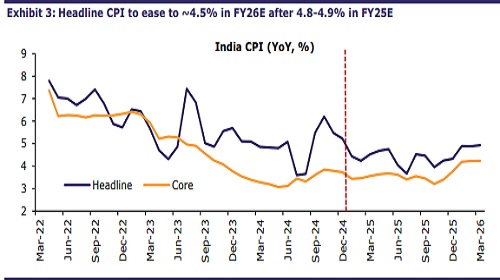

(2) Inflation concerns easing: Noisy food inflation drove a large part of the headline inflation in FY25, while demand slack continued to keep core subdued. However, near-term food pressures look to be abating with broad-based easing across food categories, and Jan-25 inflation tracking sub-4.5% (Dec: 5.2%). Q4FY25E headline inflation is likely to ease to 4.4% vs 5.6% in Q3FY25, supported by strong Kharif output. For FY26 as well, inflation on an average will ease to ~4.5% vs 4.8%-4.9% in FY25. Separately, our introspection of the Budget belies some unfounded fears that a consumption-focused budget could be inflationary and impact the RBI’s reaction function.

(3) Perceptible change in INR management stance: We have been arguing that the fluidity of global dynamics would be playing an important role in the RBI's conventional rate cuts, especially with mounting INR pressures. Despite recent swings in broad dollar and EMFX on tariff noises, RBI has now been turning more judicious on its INR defense after an aggressive intervention strategy in Q3FY25 (over ~USD110bn in spot+fwd). We think the policy trilemma could tilt more toward letting the INR find its equilibrium to some extent, and provide some policy flexibility to the RBI on rate settings in general. The recent dollar weakness has given some breathing space to EMFX (and INR), which could also provide some wiggle room to the RBI on its monetary reaction function. We note that Indonesia recently cut rates amid growth concerns, despite IDR pressures and a heavy FPI debt exposure (over ~15% ownership). Conversely, India has limited FPI debt exposure (~3.0%) and generally sees FPI flows led more by equities (which are further driven by growth differentials with EM peers than conventionally-perceived interest differentials).

Watch for more unconventional policy tools like liquidity and regulatory easing Recent RBI measures since Dec-24 were a beginning of easing by stealth, in our view, and we think that this route will continue ahead. Normalizing CRR to 4.0% (adding >~Rs1trn liquidity) in Dec-24 was the first of the liquidity infusion steps, followed by a slew of measures in Jan-25 (adding ~Rs1.5 trn liquidity). While system liquidity has eased from the highs of over Rs3.1 trn in end-Jan-25, the recent measures may lend further support. However, our estimates suggest that despite these measures, system liquidity deficit could stay high at ~Rs2.5-2.8 trn by end-FY25, with core deficit at ~Rs1.1-1.3 trn, implying more measures are on the anvil if RBI finds this tune of deficit uncomfortable for policy transmission, especially as the depth of cut cycle is still arguable. We expect more OMOs in primary/secondary markets, followed by VRRs and more FX swaps, especially as the RBI’s forward book is heavy with large near-term maturity (~USD68bn outstanding as of Dec-24). We expect additional OMO purchases of ~Rs300 bn, implying net OMOs of ~Rs900 bn+ in FY25E. We also watch for more capital account measures to make the FCNR deposit scheme more lucrative.

(I)CRR cut a close call: We understand that non-sovereign curve has not enjoyed the easing experienced by the sovereign Gsec curve, as the drivers of both are different. Indeed the 3M/1Y CD rate spreads have reached the highs of 85bps/100bps against Repo and 89bps/98bps against the respective tenor T-bills. This partly reflects the short-term liquidity pain in CD/CP markets, with lack of deposits being one of the issues. While the RBI may want to address this by cutting CRR by 50bps in two steps temporarily, we reckon a temporary CRR cut is unlikely to lead banks to create deposit base of 1Y+ maturity. Conversely, easing of ensuing tighter LCR norms and regulatory lending norms will help re-spur waning credit offtake better (and consequently improve deposit creation).

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354