Economic Pathways August 2025 by CareEdge Ratings

Global Growth Outlook

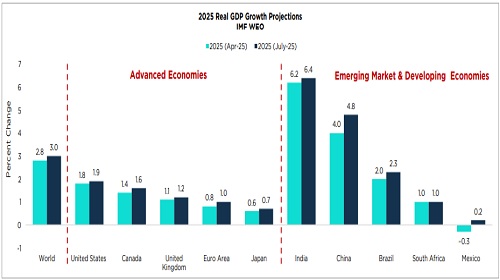

Broad-based Upward Revisions to Growth Amid Strong Trade Front-Loading

* Strong front-loading in international trade, lower worldwide effective tariff rates vis-à-vis April expectations and improvement in global financial conditions supported the upward revisions to the 2025 growth forecasts across economies.

* This front-loading is expected to unwind in the coming quarters, keeping the 2025 growth below the pre-pandemic historical average of 3.7%.

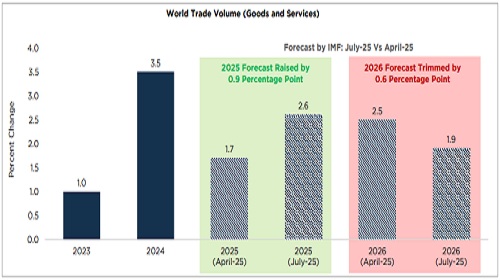

Global Trade Outlook

Global Trade Conditions Remain Volatile

* Front-loading of some trade flows in anticipation of tighter trade restrictions provided a near-term offset. This is expected to fade in the second half of 2025.

* However, the 2026 trade growth forecast has been trimmed lower amid volatile global trade conditions.

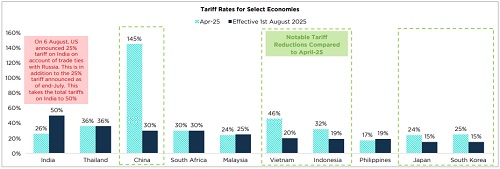

Global Tariff Developments

India’s Relative Tariff Edge from April has now Reversed

* Since August 1, 2025, the US has lifted the temporary pause on the reciprocal tariffs announced on multiple trading partners earlier this year.

* Several Asian economies (such as Vietnam and Indonesia) have announced trade deals with the US, thereby negotiating a lower level of reciprocal tariffs.

* In addition to the 25% tariff announced in July, India is expected to face a further 25% tariff from 27 August due to its trade ties with Russia.

* Thus, India’s likely tariff rate at 50% is notably higher compared to its Asian peers, such as Vietnam (reciprocal tariff of 20%), Indonesia (19%) and South Korea (15%)

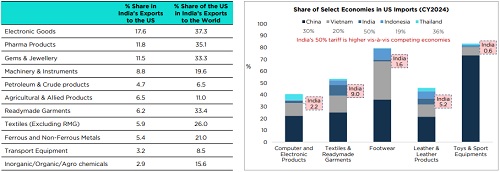

Impact of US Tariffs on India

Impact on Key Sectors

* India is a domestic-driven economy with a low share of goods exports to the US (at ~2% of GDP). This should provide some buffer to India.

* Given that India now faces higher tariffs compared to other economies, there is growing pressure on the country to negotiate a trade deal with the US.

* However, India is likely to remain cautious about opening up sensitive sectors such as agriculture and dairy, so the negotiations may take some time to conclude.

* Although pharmaceuticals and select electronics currently remain on the exemption list, the risk of tariffs being imposed on these sectors persists.

* Discretionary items like gems and jewellery may feel the heat of reciprocal tariffs. Furthermore, key US suppliers of footwear, textiles and leather, like Vietnam and Indonesia, could gain from lower US tariffs compared to India.

US Doubled Tariffs on India on account of Oil Imports from Russia

Role of Russia in India’s Oil Imports

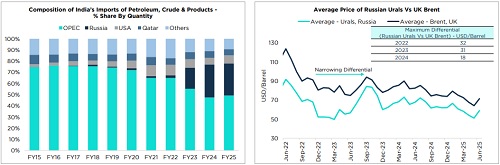

* Share of OPEC countries in India’s total imports of petroleum, crude and products has declined successively from ~75% a decade ago to 50% in FY25.

* Subsequently, there has been an increase in the share of imports from Russia (29% share in FY25 from 0.2% in FY15) and the USA (7% in FY25 from 2% in FY15).

* Latest data suggests that the price differential between Russian Ural and Brent Crude has further narrowed to around USD 3 per barrel as of early August.

* Thus, any diversification in India’s oil imports away from Russia is expected to have a minimal impact on India’s oil import bill. However, such diversification away from Russian oil by other countries could add to the upward pressures on global crude oil prices.

Above views are of the author and not of the website kindly read disclaimer