Pain continues - India underperforms global markets by Motilal Oswal Financial Services Ltd

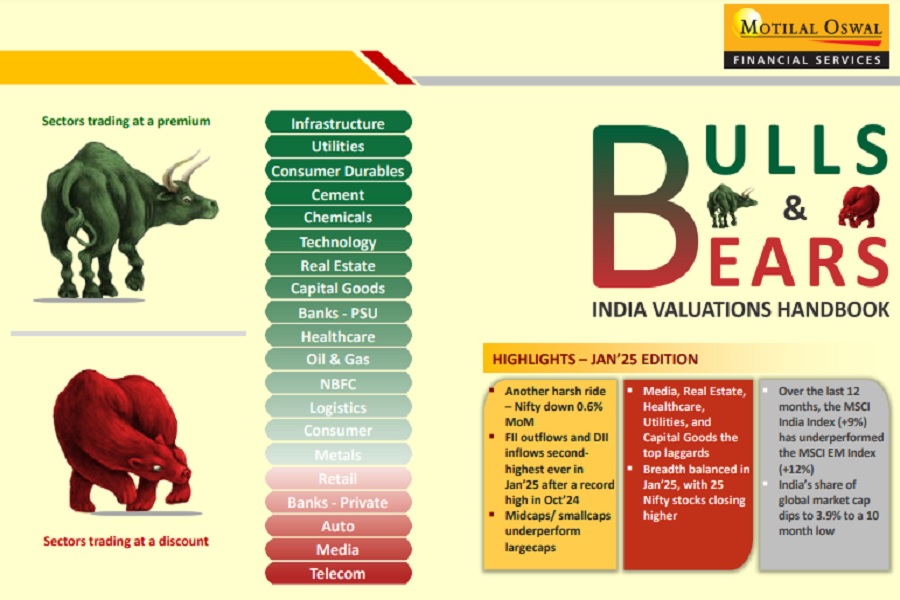

The Indian equity market continues to struggle, marking its fourth consecutive month of losses, with Nifty declining 0.6% MoM in January 2025. While large caps gained 8% YoY, midcaps and smallcaps delivered 11% and 6% returns, respectively.

However, India’s share in global market capitalisation dropped to 3.9%, a 10-month low, highlighting its underperformance against global markets.

Institutional Flows: DII Strength vs. FII Sell-Off

A stark divergence in institutional flows continues to shape market trends. Foreign Institutional Investors (FIIs) withdrew USD 8.4 billion in January, making it the second-highest monthly outflow in history. In contrast, Domestic Institutional Investors (DIIs) infused USD 10 billion, marking their second-largest monthly inflow ever.

For CY24, DIIs invested a record USD 62.9 billion, overshadowing FII net outflows of USD 0.8 billion. The consistent FII exodus suggests global risk-off sentiment, valuation concerns, and macroeconomic uncertainties driving the pullback.

Global Markets Surge While India Lags

Indian equities underperformed most global markets in January 2025, with indices in the UK (+6%), Korea (+5%), Brazil (+5%), and the US (+3%) posting strong gains. Meanwhile, India declined (-1%) and trailed the MSCI Emerging Markets Index (+2%).

Over the past 12 months, the MSCI India Index (+9%) has lagged behind the MSCI EM Index (+12%), marking a period of relative weakness for Indian markets compared to global peers.

Earnings Outlook Softens, Downgrades Accelerate

The 3QFY25 earnings season has been largely in line with expectations, but forward earnings revisions remain weak. Downgrades outpace upgrades, suggesting that corporate profitability could face headwinds.

The Nifty-50 is now projected to post a modest 5% EPS growth in FY25E, a stark contrast to the 20%+ CAGR seen between FY20-24.

Two-Thirds of Sectors Trade at a Premium

Despite recent market weakness, valuations remain elevated, with two-thirds of sectors currently trading above their historical averages.

The Nifty’s P/E ratio stands at 19.9x, marginally below its long-term average of 20.6x, while the P/B ratio (3.1x) reflects an 11% premium. This suggests that, despite near-term corrections, Indian equities remain expensively priced relative to historical levels.

Cement Sector Gears Up for Recovery

The cement industry has attracted investor interest, trading at a 32% premium to its historical EV/EBITDA multiple, supported by expectations of 7-8% CAGR growth between FY25-27.

Even though pricing trends remained weak in CY24, the sector has seen sequential profitability improvement due to a combination of better demand, easing raw material costs, and selective price hikes in December 2024.

Technology and Industrials Maintain Valuation Premiums

The technology sector continues to trade at a 31% premium to its historical averages, supported by robust BFSI-driven IT spending and global digital transformation trends.

Similarly, capital goods and industrials have remained elevated, buoyed by strong domestic and government capex cycles.

Market Strategy – Positioning for 2025

With markets at elevated valuations and earnings growth slowing, sector allocation becomes critical.

LTTS remains overweight on Consumption, BFSI, IT, Industrials, Healthcare, and Real Estate, while adopting a cautious stance on Oil & Gas, Cement, Automobiles, and Metals.

Stock Picks for 2025

* Large Caps: ICICI Bank, SBI, Bharti Airtel, L&T, Sun Pharma, Maruti Suzuki, Titan, Trent

* Midcaps & Smallcaps: Indian Hotels, Dixon Tech, Godrej Properties, Coforge, Page Industries

With high valuations, global uncertainties, and slower earnings momentum, investors should adopt a disciplined allocation approach, prioritising quality large caps and select high-growth midcaps.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Tag News

Daily Market Commentary : Nifty?ended with marginal gains of 8 points at 22,553 level, closi...

More News

MOSt Market Roundup : The Nifty dropped slightly by 26 points, or 0.1%, closing at 23,045, a...