Options Result Edge strategy on Reliance Industries by Axis Securities

Reliance Industries Ltd

Must Knows

* Reliance closed out the September expiration cycle on a negative note 1.6% while rollover stood at 96% v/s a 3-month average of 95%, indicating that short positions have rolled to current series.

* For the current expiry, the stock is up by 3.6% with rise in open interest to the tune of 4.8% indicating short positions have started unwinding so far.

* The One-month IV has jumped 20% to 22% over 10 days, while HV stays at 24%, signaling rising option demand and market uncertainty.

* The difference between avg1-month Implied Volatility (IV) and Historical Volatility (HV) is −4.7%. This indicates that options traders anticipate reduced price swings over the next month compared to the recent past, suggesting that any volatility spike from today's results will be quickly followed.

* Put Call-Ratio (PCR) for the stock one-day prior was 0.67, which was above the 20-day rolling mean and close to the upper end of Bollinger Band.

* Compared with one week ago, 5% OTM Puts have become significantly more cheaper, while 5% OTM Calls have become expensive; this is Bullish.

* Relative to one day prior, 5% OTM Puts have fallen while 5% OTM Calls have became slightly expensive; this improving sentiment which is Bullish.

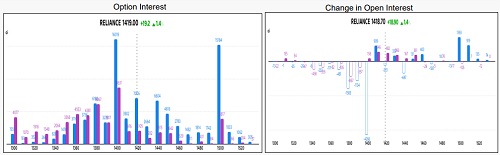

* Strong Support Base: Heavy Put OI buildup at 1380 and 1360 provides a solid support floor.

* Resistance : 1500 Strike holds the Major OI Concentrate while 1400 Call has seen massive unwinding opening the price to move higher.

* Range : The OI profile suggests a short-term trading range most likely between 1380 (Strong Support) and 1500 (Strong Resistance).

Observations:

* View: Bullish based on the options skew, as compared to one day and one week ago.

* Seasonality: Based on the past decade, this October’s ~4.1% gain far exceeds the historical average of 0.9%. Historically, November averages 0.7% gains, with positive returns in 5 out of 10 years, broadly in line with October’s trend.

* Over the past decade, October has generally led the seasonal trend, showing a 50% probability of a positive return. This performance is on par with November, which also shows a 50% chance of gains, and outperforms December, where the probability of a positive return drops to 40%.

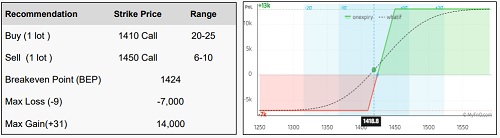

* Suggested Strategy: Bull Call Spread

* Bull Call Spread is a strategy deployed when the view is that the price of the underlying will increase ahead of expiry, with both the profit and loss capped.

* It is a net debit strategy where there is a premium outflow, with the maximum loss capped at the premium paid.

* Traders could initiate this spread strategy to make modest returns amid limited risk and reward.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633