Opening Bell : Markets likely to make flat-to-positive start amid strong global cues

Indian equity markets are likely to make flat-to-positive start on Thursday amid strong global cues. Further, investors may take support from foreign institutional investors (FIIs), who were net buyers of shares worth Rs 1,154.34 crore on Wednesday.

Some of the key factors to be watched:

India, Canada FTA talks to finalize next month: The report has said that India and Canada are expected to finalise terms of reference for initiating talks for a free trade agreement (FTA) during the visit of Canadian Prime Minister Mark Carney to India next month.

India keen to diversify crude oil, coking coal sources: Commerce and Industry Minister Piyush Goyal has said that India wants to diversify its sources of crude oil and coking coal and would love to source high-quality coking coal from the US.

RBI mandates UTI for all OTC derivatives trades from January 1: The Reserve Bank of India (RBI) has said that Unique Transaction Identifier (UTI) will become mandatory for all direct private trades in rupee interest rate and foreign currency derivatives from January 1, 2027.

India to be 3rd largest economy by 2027-28: As per private report, Commerce and Industry Minister Piyush Goyal has said India is on track to become the world’s third-largest economy by 2027 and is working towards building a $30-35 trillion economy by 2047.

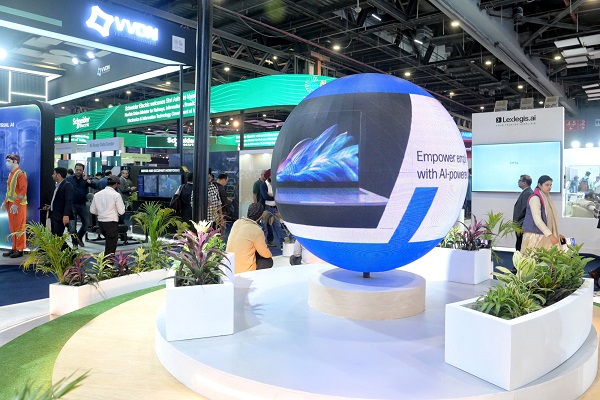

AI-driven technologies can help in managing the grid stability: Union Minister Pralhad Joshi has said that integration of AI-driven technologies can be useful in managing the stability of the grid in India, where capacities are being added on a large scale.

On the global front: The US markets ended in green on Wednesday as shares of Nvidia (NVDA) surged after the AI chipmaker announced a multi-year, multi-generational strategic partnership with Facebook parent Meta (META) spanning on-premises, cloud and AI infrastructure. Asian markets are trading in green on Thursday with several bourses in the region returning from the Lunar New Year holiday.

Back home, Indian equity benchmarks extended their gains for the third straight session on Wednesday, driven by last-hour buying in Metal, FMCG and Capital Goods shares. Markets sentiment was also supported by renewed buying interest from foreign institutional investors (FIIs). On Tuesday, FIIs turned net buyers and purchased equities worth Rs 995.21 crore, according to exchange data. Finally, the BSE Sensex rose 283.29 points or 0.34% to 83,734.25 and the CNX Nifty was up by 93.95 points or 0.37% to 25,819.35.

Some of the important factors in trade:

India, France elevate ties to special global strategic partnership: India and France have elevated their bilateral ties to a Special Global Strategic Partnership, with Prime Minister Narendra Modi describing the relationship as a force for global stability amid rising geopolitical turbulence.

Sitharaman holds talks with Norway finance minister on renewable collaboration: Nirmala Sitharaman has held talks with Norway Finance Minister Jens Stoltenberg on potential collaboration in renewable energy, especially on solar power, rare earth processing, and carbon capture and storage.

Govt invested in creating indigenous AI technology to address issue of bias: The Ministry of Electronics and Information Technology (MeitY) Secretary, S Krishnan, has said that the government invested in creating indigenous and sovereign artificial intelligence (AI) models to address bias and to ensure that India has AI systems trained primarily on Indian data.

Above views are of the author and not of the website kindly read disclaimer