Oil steady as markets consider possible U.S.–Iran de-escalation, firm dollar

Oil prices held steady on Tuesday as market participants weighed the possibility of a de-escalation in U.S.-Iran tensions, with a firmer dollar limiting the upside.

Brent crude futures were up 6 cents, or 0.1%, at $66.36 per barrel at 0102 GMT. U.S. West Texas Intermediate crude was at $62.24 per barrel, up 0.2%.

Oil prices fell more than 4% on Monday after U.S. President Donald Trump said Iran was "seriously talking" with Washington, signaling a de-escalation of tensions with the OPEC member.

Iran and the U.S. are expected to resume nuclear talks on Friday in Turkey, officials from both sides told Reuters on Monday, and Trump warned that with big U.S. warships heading to Iran, bad things could happen if a deal was not reached.

Limiting the upside, the U.S. dollar index hovered near a high of more than a week. A stronger greenback hurts demand for dollar-denominated crude from foreign buyers.

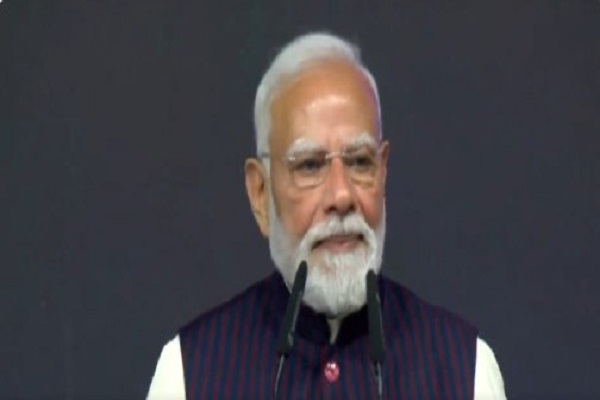

On the trade front, Trump on Monday unveiled a deal with India that slashes U.S. tariffs on Indian goods to 18% from 50% in exchange for India halting Russian oil purchases and lowering trade barriers.

Trump announced the deal on social media following a call with Indian Prime Minister Narendra Modi, noting that India had agreed to buy oil from the U.S. and possibly Venezuela.

Recently, India had started to slow its purchases from Russia. In January, they stood at around 1.2 million barrels per day (bpd) and are projected to decline to about 1 million bpd in February and 800,000 bpd in March, according to a Reuters report.

OPEC+ agreed to keep its oil output unchanged for March, the group said on Sunday.

The eight members - Saudi Arabia, Russia, the United Arab Emirates, Kazakhstan, Kuwait, Iraq, Algeria and Oman - raised production quotas by about 2.9 million bpd from April through December 2025, roughly 3% of global demand.