O/S Spreads Inch Up Sequentially in October 2025 by CareEdge Ratings

Synopsis

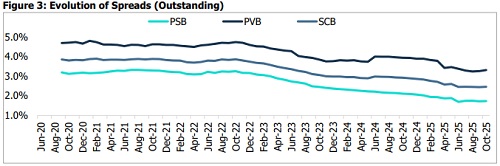

In October 2025, the spread between the outstanding (o/s) weighted average lending rate (WALR – Lending Rate) and the o/s weighted average domestic term deposit rate (WADTDR – Deposit Rate) for scheduled commercial banks (SCBs) marginally increased by two basis points (bps) on a month-on-month (m-o-m) basis, to 2.46%.

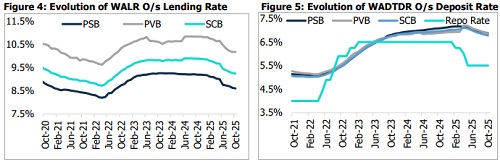

* The SCBs’ lending rate on o/s rupee loans fell by two bps m-o-m to 9.24%, driven by transmission of earlier policy rate cuts, softer credit demand, and competitive pricing pressure among banks.

* The deposit rate on o/s rupee term deposits also decreased by four bps to 6.78%, driven by a five-bps reduction of Private banks (PVBs), and a four-bps reduction in public sector banks (PSBs), respectively.

* In October 2025, SCBs’ fresh spread increased by 17 bps, standing at 3.07%, primarily attributed to credit growth with the festive season, portfolio shift towards higher yield segments and banks defending margins amid slower rate-cut transmission. Overall, spreads remained stable, supported by a shift in the loan mix toward segments offering higher returns.

* As of October 2025, lending rates on fresh loans for SCBs increased by 14 bps m-o-m to reach 8.64%, while deposit rates on fresh loans were down marginally by three bps m-o-m to 5.57% respectively. Banks have taken conscious efforts to protect lending rates by shifting exposures from very low-yield segments to those providing slightly better yields.

* In November 2025, the one-year median MCLR decreased by five bps m-o-m to 8.55%, attributed to a slight easing in the cost of funds for banks. Additionally, they were majorly impacted by foreign banks. Furthermore, the MCLR of PSBs declined by three bps to 8.80%. In comparison, PVBs experienced a larger reduction than PSBs, declining by five bps to 9.40%. Meanwhile, FBs decreased by 12 bps to 6.88%, indicating transmission catch-up among PVBs during the month.

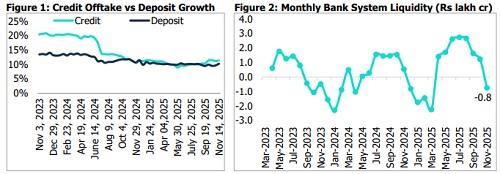

Credit Offtake Outpaces Deposit Growth; Systemic Liquidity Drops to Deficit

* Bank credit off-take registered a y-o-y growth of 11.4% as of the fortnight ending November 14, 2025, compared to 11.6% excluding merger impact. In absolute terms, credit expanded by Rs 15.4 lakh crore during the past ten months, reaching Rs 193.5 lakh crore. Overall growth was driven by recent GST rate reductions, steady traction in retail and MSME segments, and an uptick in corporate borrowing amid elevated bond yields. As of November 14, 2025, aggregate bank deposits stood at Rs 240.9 lakh crore, up 10.2% y-o-y. Deposit growth continued to lag the 11.5% (ex-merger) expansion recorded in the corresponding period last year, largely due to a shift of funds towards higher-yielding alternative investment avenues.

* As per CareEdge Economics, as of the end of November 2025, the RBI witnessed a deficit after remaining surplus for six consecutive months, with the average deficit standing at around Rs 0.8 lakh crore. Banking system liquidity briefly slipped into deficit, primarily due to GST outflows and an increase in currency in circulation amidst the festive season. In the near term, liquidity conditions are expected to remain comfortable, supported by the remaining CRR cuts.

O/s Spread Witness a Marginal Uptick in October 2025

As of October 2025, the outstanding spread between lending and deposit rates for SCBs improved marginally by two bps m-o-m to 2.46%, attributed to credit growth with the festive season, liquidity tightening, and a shift towards higher-yielding segments.

Outstanding Business: Deposit and Lending Rate Decline

* As of October 2025, SCBs' outstanding lending rate decreased by two bps m-o-m to 9.24%, with PSBs reducing by three bps to 8.60%, while PVBs remained flat at 10.17% as banks passed on the rate cuts but moderated the impact of falling yields by adjusting the loan mix. Meanwhile, the outstanding deposit rates of SCBs decreased by four bps to 6.78%, reflecting repricing of deposit portfolios toward lower market rates, helping ease funding costs and protect margins. PSBs, PVBs, and FBs declined by four, five and one bps, reaching 6.87%, 6.86% and 5.14% respectively.

Above views are of the author and not of the website kindly read disclaimer