NYMEX Crude oil may slip towards $58.50 level as long as it trades below $60.50 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with positive bias and rise towards $5000 level on weak dollar and softening of US treasury yields. Further, prices may move up on expectation of 2 more rate cut this year. Additionally, demand for precious metal may be seen amid fiscal concerns and uncertainty still linger as European lawmakers halted approval of the EU–US trade agreement reached in July. Moreover, concern over Fed independence and strong central bank buying would be supportive for the prices. The National Bank of Poland approved a plan to buy as much as 150 tons of gold. Increasing country’s holdings to 700 tons. Meanwhile, all eyes will be on Bank of Japan monetary policy meeting and economic data from US

* MCX Gold Feb is expected to rise towards Rs 158,500-Rs 159,000 level as long as it stays above Rs 153,000 level.

* MCX Silver March is expected to rise towards Rs 340,000 level as long as it stays above Rs 315,000 level.

Base Metal Outlook

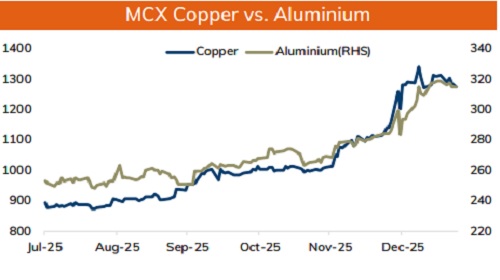

* Copper prices are expected to trade with a positive bias amid weak dollar and optimistic global market sentiments. Further, prices may move up on supply concerns as production in mine in Chile has been halted amid 3 week labor strike. This mine could produce 106,000 tons per year. Additionally, expectation of improved manufacturing pmi data from major economies would be supportive for the prices. Meanwhile, signs of softening demand from China would be weigh on prices. The Yangshan copper premium, a gauge of Chinese consumers' appetite for imported copper, declined to $22 a ton, down from above $50 by the end of 2025.

* MCX Copper Jan is expected to recover towards Rs 1292 level as long as it stays above Rs 1250 level. A break above Rs 1292 level may open doors for Rs 1300-Rs 1310 level

* MCX Aluminum Jan is expected to slide towards Rs 310 level as long as it stays below Rs 319 level. MCX Zinc Jan is likely to face stiff resistance near Rs 315 level and slip towards Rs 307 level

Energy Outlook

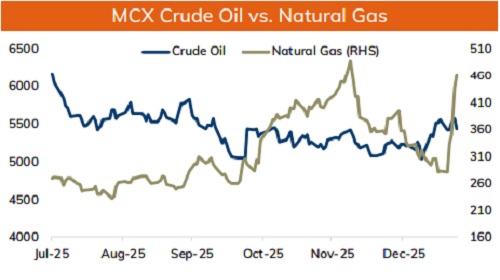

* NYMEX Crude oil is likely to trade with negative bias and slip towards $58.50 level on ease in geopolitical tension and supply glut. US President Doland Trump softened his threats towards Greenland and Iran. Trump said he hope there would be no further military action in Iran and has secured total and permanent access to Greenland in a deal with NATO. Moreover, Ukraine President announced plan for trilateral meeting with US and Russia. Any breakthrough to end the war may lift sanctions on Russian oil. Additionally, EIA data showed rise in crude oil and fuel stocks, signaling weak demand.

* NYMEX Crude oil may slip towards $58.50 level as long as it trades below $60.50 level. On MCX Crude oil Feb is likely to slip towards Rs 5350-Rs 5300 level as long as it stays below Rs 5600 level.

* MCX Natural gas Feb is expected to rise towards Rs 345 level as long as it stays above Rs 300 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631