Nippon India Mutual Fund Dominates volumes in Gold & Silver ETF during Diwali 2025 with 53% Market Share

Nippon India Mutual Fund (NIMF) has maintained a leadership position in its Gold and Silver ETF offerings, both in terms of Asset under management (AUM) as well as average daily turnover (ADT) on the exchange. Continues to reinforce its dominant position in the commodities ETF segment with Nippon India GoldBeES ETF and Nippon India SilverBeES ETF maintaining clear leadership across key parameters — AUM, net sales, daily trading volumes, and investor folios.

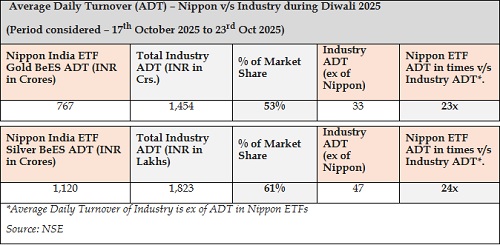

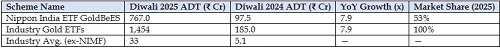

According to NSE data, during the Diwali 2025 period (17th–23rd October 2025, the industry’s average daily turnover (ADT) in Gold ETFs surged 7.9x year-on-year — from ?185 crore in Diwali 2024 to ?1,454 crore in 2025.

During Diwali 2025, NIMF recorded a commanding INR 1,887 crore in combined average daily turnover across its Gold and Silver ETF, capturing a significant 57.6% share of the total industry average daily turnover in this segment.

Nippon India GoldBeES ETF: Sustaining Category Leadership Strong Diwali 2025 Performance:

According to NSE data, during the Diwali 2025 period (17th–23rd October 2025)

Average Daily Turnover (ADT) for Gold ETF – NAM v/s Industry

* Nippon India ETF GoldBeES recorded a similar 7.9x rise in ADT, climbing from ?97 crore in Diwali 2024 to ?767 crore in Diwali 2025, maintaining its strong leadership with a 53% market share of total industry ADT.

* The fund’s ADT during Diwali 2025 was ~23 times higher than the industry average (excluding NIMF), reinforcing its status as the most liquid Gold ETF on the exchange.

* Market share in terms of ADT of our GOLDBEES stood at 53% of total Industry Gold ETF ADT

* Nippon India ETF Gold BeES ADT during Diwali 2025 was over ~23 times higher than industry average (ex-NIMF)

The higher volume traded on NIMF’s ETFs reflects its strong market liquidity—an essential feature for investors seeking to minimize tracking error and reduce impact cost. Notably,

NIMF Gold ETF’s impact cost stood at just 2 basis points (bps), significantly below the industry average of 18 bps (ex-Nippon). Similarly, NIMF Silver ETF reported an impressively low impact cost of 2bps, compared to the industry average of 20 bps (ex-Nippon).

“In an asset class like ETFs, liquidity is crucial. Lower impact costs make a material difference to investors, especially when entering or exiting large positions,” a senior spokesperson from Nippon India Mutual Fund said. “Our leadership in the space ensures that investors have access to one of the most efficient ETF platforms in the country.”

NIMF's dominance extends beyond just festive trading days. For the financial year 2024–25, the fund house captured a robust~58% share of the industry’s average daily turnover in Gold and Silver ETFs. Moreover, NIMF boasts the largest ETF investor base in the country with 1.53 crore investors as on September 2025—comprising ~50% of the total ETF investors across the industry.

With consistent performance, superior liquidity, and strong investor trust, Nippon India Mutual Fund continues to solidify its position as the go-to choice for Gold and Silver ETF investments in India.

Nippon India SilverBeES ETF: Reinforcing Leadership Exceptional Growth During Diwali 2025:

Average Daily Turnover (ADT) for Silver ETFs – NAM v/s Industry

* The industry’s Silver ETF ADT rose 14x, from ?130 crore in Diwali 2024 to ?1,823 crore in Diwali 2025.

* Industry Silver ETF ADT up from INR 130 Crs. during Diwali 2024 to 1,823 Crs. during Diwali 2025 i.e. 14x growth

* While, Nippon India Silver ETF ADT up from ~INR 84 Crs. to INR 1,120 Crs. i.e. 13.4x growth in line with Industry

* Nippon India Silver ETF ADT during Diwali 2025 was over ~24 times higher than industry average (ex-NIMF)

* The fund captured a commanding 61% share of the total Silver ETF ADT during Diwali 2025, with its turnover being ~24 times higher than the industry average (excluding NIMF).

Key Points:

* Higher traded volume reflects higher liquidity. Investors prefers higher liquidity as it helps reducing impact cost and tracking error which is important from investment perspective

* Due to higher Gold and Silver ETF volume, NIMF impact cost is significantly lower as compared to other ETFs in the Industry:

* Impact cost for NIMF Gold ETF is just at 2 bps vs Industry average of 18 bps (ex-nippon)

* Impact cost for NIMF Silver ETF is just at 2 bps vs Industry average of 20 bps (ex-nippon)

* NIMF has been the dominant player in the Industry in terms of Gold and Silver ETF

* In the last financial year i.e., FY24-25, NIMF had ~58% of total Industry average daily turnover of Gold + Silver ETF

* NIMF has the highest ETF investor base in the Industry; NIMF Total ETF Investor base at 1.5 Cr which is ~50.4% % of total ETF investor base in the Industry as on September 2025

Data Points:

Nippon India ETF GoldBeES

Nippon India Silver ETF

Above views are of the author and not of the website kindly read disclaimer

Tag News

Perspective on Gold Hits High from NS Ramaswamy, Head of Commodity & CRM - Ventura