Nifty started the week strong, closing above 24250-24300, keeping uptrend intact - Tradebulls Securities Pvt Ltd

Nifty

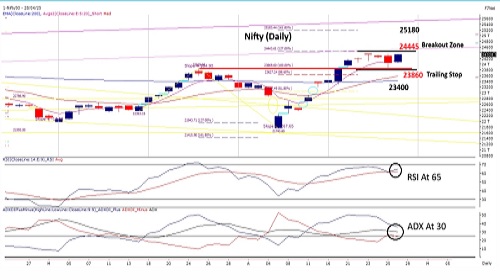

Nifty kicked off the week on a strong footing, closing firmly above its 24250-24300 hurdles, reinforcing the prevailing uptrend to continue without any hiccups. The index continues to maintain its higher-top, higher-bottom structure, trading confidently above its 5-DEMA placed at 24030—a key short-term support level. This bullish setup remains intact unless the index closes decisively below the 23400 level, where a critical confluence of moving averages provides strong support. Notably, the key support zone has shifted higher—from 22900 to 23400—bolstered by a significant moving average crossover, which further validates the bullish bias. On the upside, a breakout above the immediate hurdle at 24445 could open the gates for a swift rally toward 25180. Momentum traders are advised to stay long while trailing their stop-loss higher to 23930. Technically, the daily RSI continues to trade below its previous peak of 71.65, suggesting further room for upside before hitting overbought territory. Meanwhile, the ADX reading above 30 confirms trend strength, although it signals the rally is entering a more mature phase. A dip below 23930 may lead to short-term exhaustion and could warrant a more cautious approach. Conversely, a breakout above 24445 would likely reignite momentum and accelerate the rally toward the 25180 zone.

Please refer disclaimer at https://www.tradebulls.in/disclaimer

SEBI Registration number is INZ000171838

More News

Nifty edged lower after a brief respite, losing nearly a percent, weighed down by weak globa...