Nifty Open Interest Put Call ratio rose to 0.86 levels from 0.81 levels - HDFC Securities Ltd

SHORT COVERING WAS SEEN IN THE BANKNIFTY NIFTY FUTURES

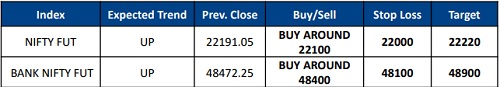

Create Longs Around 22100 with the SL Of 22000 Levels.

* The Nifty index fell for the tenth consecutive session, the longest losing run in 29 years, decreasing by 36 points or 0.17%, to close at 22082. Out of the last 19 trading sessions, only one session has ended in positive territory.

* Short Build-Up was seen in the Nifty Futures where Open Interest rose by 2.24% with Nifty falling by 0.17%.

* Short Covering was seen in the Bank Nifty Futures where Open Interest fell by 2.19% with Bank Nifty rising by 0.27%.

* Nifty Open Interest Put Call ratio rose to 0.86 levels from 0.81 levels.

* Amongst the Nifty options (06-Mar Expiry), Call writing is seen at 22200-22300 levels, indicating Nifty is likely to find strong resistance in the vicinity of 22200-22300 levels. On the lower side, an immediate support is placed in the vicinity of 22000-21900 levels where we have seen Put writing.

* Short build-up was seen by FII's in the Index Futures segment where they net sold worth 37 cr with their Open Interest going up by 5727 contracts.

Nifty : Slowdown in selling momentum and minor buying seems to have started from the lows. Need more upside to consider reversal pattern.

Nifty PSU Banking : Formation of bullish pattern indicates lower bottom formation. Upside bounce could be on cards.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133

More News

Nifty has an immediate Support at 24500 and on a decisive close below expect a fall to 24440...