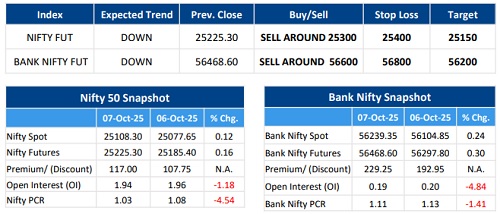

Nifty Open Interest Put Call ratio fell to 1.03 levels from 1.08 levels - HDFC Securities Ltd

F&O Highlights

SHORT COVERING WAS SEEN IN NIFTY FUTURES

Create shorts on rise with the SL of 25400 levels.

* Nifty extended its rally for the fourth straight session, rising to an intraday high of 25,220 before late profit booking after 2:15 PM erased most gains. It closed up 30 points at 25,108.

* Short Covering was seen in the Nifty Futures where Open Interest fell by 1.18% with Nifty rising by 0.12%.

* Short Covering was seen in the Bank Nifty Futures where Open Interest fell by 4.84% with Bank Nifty rising by 0.24%.

* Nifty Open Interest Put Call ratio fell to 1.03 levels from 1.08 levels.

* Amongst the Nifty options (14-Oct Expiry), Call writing is seen at 25300-25400 levels, indicating Nifty is likely to find strong resistance in the vicinity of 25300-25400 levels. On the lower side, an immediate support is placed in the vicinity of 25200-25100 levels where we have seen Put writing.

* Short covering was seen by FII's’ in the Index Futures segment where they net bought worth 1,549 cr with their Open Interest going down by 8056 contracts.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133

.jpg)