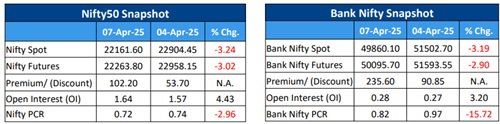

Nifty Open Interest Put Call ratio fell to 0.72 levels from 0.74 levels - HDFC Securities Ltd

GIFT NIFTY IS SUGGESTING GAP UP OPENING

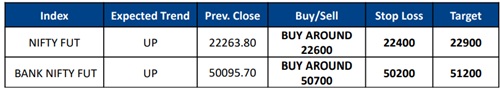

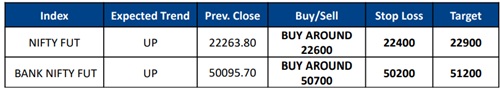

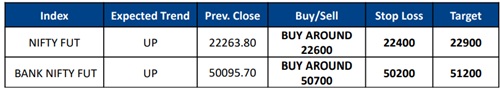

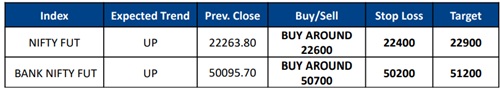

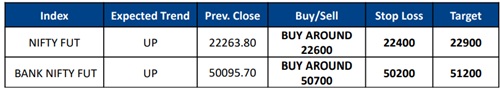

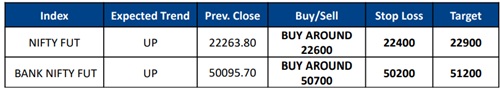

Create Longs with the SL of 22400 Levels

* The benchmark Nifty index experienced exceptional volatility yesterday, opening with a dramatic 5% gap down due to negative global cues—marking the steepest opening decline since March 23, 2020. From the day's low, the index demonstrated remarkable resilience, recovering more than 500 points to reach 22,254 by the close.

* Short Build-Up was seen in the Nifty Futures where Open Interest rose by 4.43% with Nifty falling by 3.24%.

* Short Build-Up was seen in the Bank Nifty Futures where Open Interest rose by 3.20% with Bank Nifty falling by 3.19%.

* Nifty Open Interest Put Call ratio fell to 0.72 levels from 0.74 levels. PCR was near oversold territory.

* Amongst the Nifty options (09-Apr Expiry), Call writing is seen at 22900-23000 levels, indicating Nifty is likely to find strong resistance in the vicinity of 22900-23000 levels. On the lower side, an immediate support is placed in the vicinity of 22400-22500 levels where we have seen Put writing.

* Short build-up was seen by FII's in the Index Futures segment where they net sold worth 3,335 cr with their Open Interest going up by 10173 contracts.

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133

More News

The Index can long above 26000 for the potential target of 26300 with stop loss 25830 of lev...