Nifty ends October series steady with Doji, signaling market indecision -Tradebulls Securities Pvt Ltd

Nifty

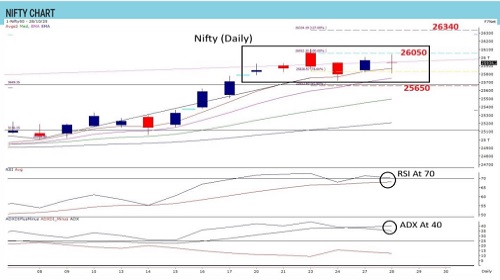

Nifty Index ended the October series on a steady note with a Doji candlestick formation on the final day, signalling indecision as the index closed within the previous day’s trading range. After a strong 14-day bullish sequence, the index has now entered a phase of consolidation over the past six sessions, oscillating between the 26050–25850 zone. Despite this pause, Nifty continues to hold firm above its 5-DEMA support at 25860, which remains a key pivot for sustaining demand within this consolidation phase. A decisive close below this level could invite a deeper correction towards the 20-DEMA support placed near 25495. On the indicator front, both RSI and ADX continue to display neutral readings, suggesting the absence of any major reversal or exhaustion signals for now. Going ahead, some consolidation or a mild retracement towards 25650–25500 may help the index establish a higher base before resuming its next upward leg. Sustaining above 25650 will keep the bullish structure intact for a potential move towards 26340-26500 with a trigger zone at 26050. The broader stance remains “buy on dips”, with a medium-term bias favoring higher levels once the consolidation phase matures

Please refer disclaimer at https://www.tradebulls.in/disclaimer

SEBI Registration number is INZ000171838